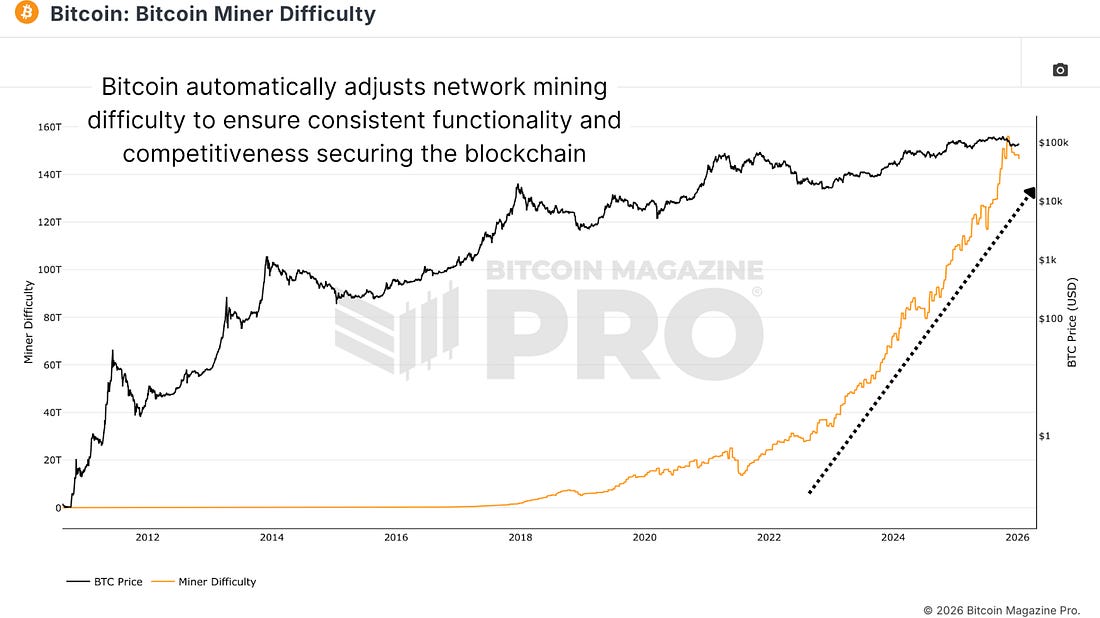

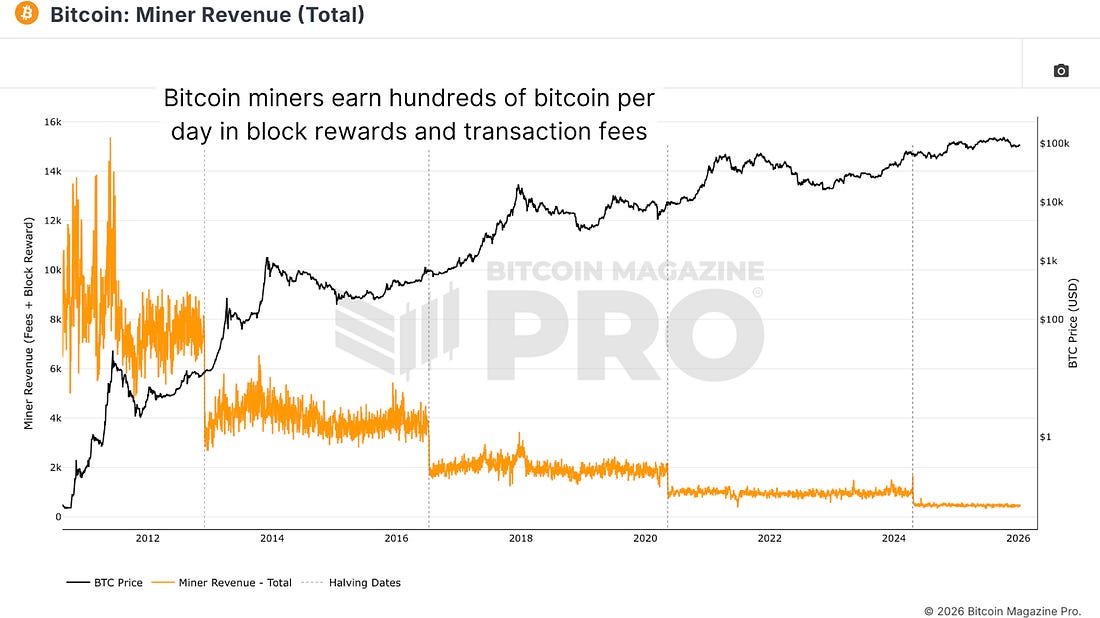

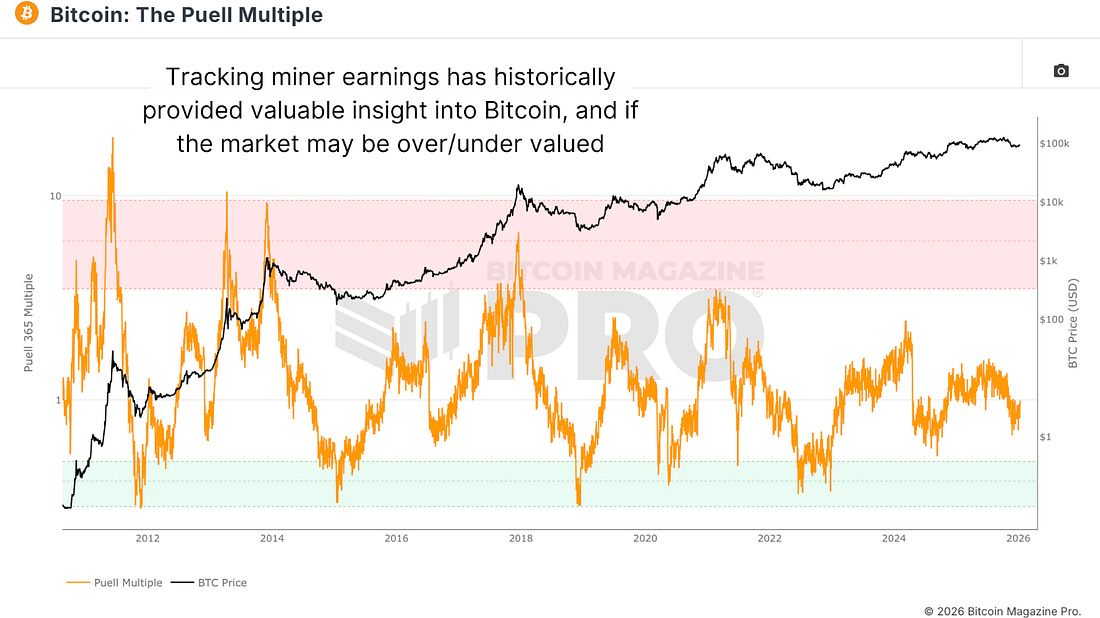

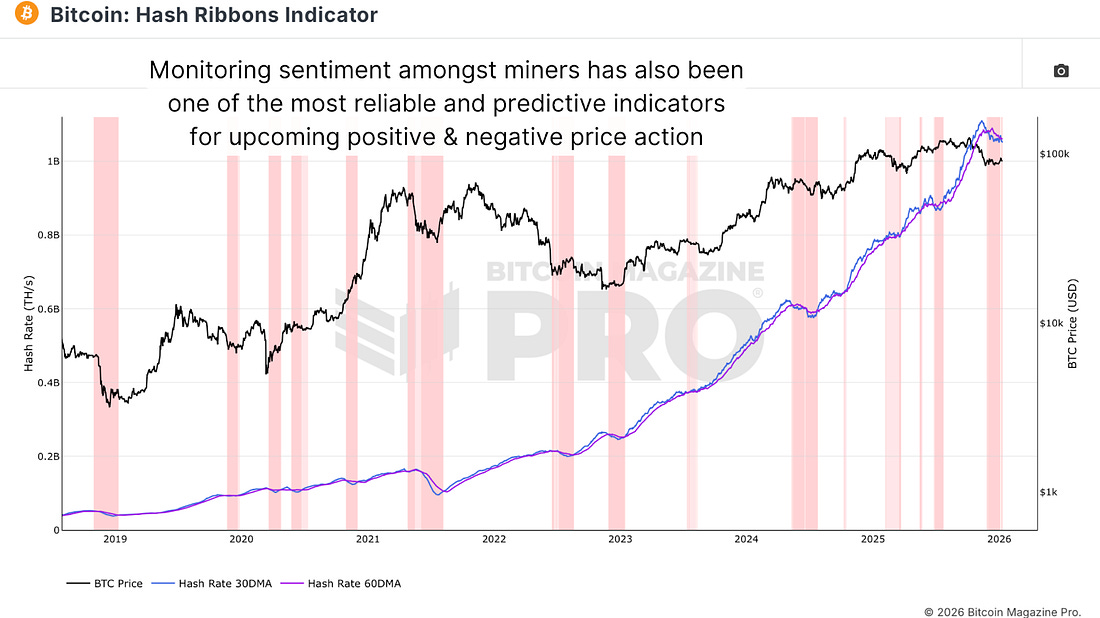

Bitcoin Mining Data & Network HealthLearn why crossings in 30-day vs. 60-day hash rate averages reveal real operational decisions by miners—and historically predict strong Bitcoin price recoveries.Bitcoin mining serves as the computational foundation securing the network while creating the economic incentives that drive Bitcoin’s monetary policy. By analyzing mining data, investors gain insights into miner confidence and network health that often exceed traditional sentiment analysis. These metrics, combined with user and derivatives data, provide a comprehensive picture of Bitcoin’s supply and demand dynamics. Mining & Block RewardsAround every 10 minutes, a new Bitcoin block containing validated transactions is mined. These blocks are stored on Bitcoin’s blockchain, its public ledger that records details of every transaction that has occurred on the platform. We typically refer to activities related to the blockchain as being “on-chain”. Miners compete using specialized computer processing units to solve mathematical problems proving block validity. The miner who successfully solves the block receives a significant reward, creating intense competition reflected in exponentially increasing Bitcoin Miner Difficulty rate (the number of hashes required to find a valid block solution), throughout Bitcoin’s history. Figure 1: The exponential rise in Bitcoin Miner Difficulty. Despite exponential increases in computational power, Bitcoin maintains 10-minute block intervals through difficulty adjustment mechanisms. Every 2016 blocks, approximately every 2 weeks, Bitcoin adjusts mining difficulty based on network hash rate. If the hash rate increases, the difficulty increases proportionally. If the hash rate decreases, the difficulty decreases. This ensures block times remain consistent despite computational power fluctuations. The Halving EventEvery 210,000 blocks, the miner block reward decreases by 50% through the Bitcoin halving event. In Bitcoin’s first epoch, miners received 50 Bitcoin per block. After another 210,000 blocks, this decreased to 25 Bitcoin. Then to 12.5 Bitcoin. Today, miners receive 3.125 Bitcoin per block. This predetermined halving schedule means Bitcoin’s inflation rate can be accurately calculated indefinitely. The next halving will occur when the block reward drops to 1.5625 Bitcoin, continuing until 2140 when block rewards reach zero. Figure 2: The impact of halving events on Bitcoin Miner Revenue. Miners also earn revenue from transaction fees, creating total revenue combining block subsidies and fees. During Bitcoin bull markets and congestion periods, transaction fee spikes can exceed block reward revenues, sometimes surpassing thousands of Bitcoin per day or millions of dollars earned by miners collectively. These fee spikes provide additional insight into on-chain activity and network utilization. The Puell MultipleThe Puell Multiple measures aggregated Bitcoin miner revenue in USD-denominated terms and divides it by yearly rolling averages. When the Puell multiple increases significantly, miners are earning substantially more Bitcoin than historical averages, suggesting potential market overheating. This usually occurs when more miners enter the network, trying to capitalize on rising prices, and more people use Bitcoin, generating higher transaction fees. Figure 3: The Puell Multiple uses miner revenues relative to their yearly rolling averages to assess market conditions. Conversely, when the Puell Multiple decreases substantially, usually fewer miners are mining, the hash rate is declining, difficulty is declining, and on-chain activity is decreasing. Miner earnings compared to previous yearly averages decrease dramatically. These periods provide clear buy and sell signals for Bitcoin price action. The Puell Multiple also illuminates the impact of halving events, where miner revenue drops approximately 50% practically instantly following the 210,000 block interval. Hash RibbonsThe Hash Ribbons Indicator compares the 30-day average hash rate against the 60-day average hash rate. When the 30-day line crosses below the 60-day line, the background turns red, indicating miners are becoming bearish and turning off machines. This is not sentiment analysis but actual operational decisions by multi-million dollar mining operations and huge public companies that must take price expectations seriously. Figure 4: The Hash Rate Ribbons Indicator provides valuable insight into the economics of mining operations. When the 30-day line crosses back above the 60-day line, the background turns white, and historically, this has marked some of the most reliable signals of upcoming bullish Bitcoin price action. Throughout recent years, hash ribbons have marked Bitcoin’s bullish periods with remarkable accuracy. This metric reflects genuine operational decisions based on expected profitability rather than emotional sentiment, making it a powerful leading indicator for price direction. ConclusionThe metrics discussed in this article are entirely free on Bitcoin Magazine Pro. Understanding these metrics enables more accurate dollar-cost averaging strategies, better timing of accumulation and distribution, and clearer comprehension of Bitcoin’s supply and demand dynamics. For access to a wider range of charts, CSV data downloads, API access, real-time alerts, and more, consider becoming one of our many site subscribers. For a more in-depth look into this topic, watch our most recent YouTube video here: Bitcoin Masterclass #3 | Mining & Network Analysis  Matt Crosby Director of Research & Analytics Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else. We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Friday, February 13, 2026

Bitcoin Mining Data & Network Health

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Bryan's $1M service product, analyzing MegaETH's lackluster performance, LayerZero announcement of blockch...

-

Also This Is a Correction for Some Assets, a Bear Market for Bitcoin & Bitcoin Is Trading as a Risk-On Asset, Not a Defensive One ͏ ...

-

Picking apart our TBL Liquidity Indicator's ability to front-run the recent move. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Analyzing the circumstances in which bitcoin finds itself in 2026. Where does it stand? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Can incumbents compete with the big banks? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

No comments:

Post a Comment