Real-Time Ethereum Arrives gm Bankless Nation,

MegaETH just launched its mainnet, pushing Ethereum toward real-time execution and new kinds of onchain experiences. Let's catch you up! Today's Issue ⬇️ - ☀️ Need to Know: MegaETH Is Live

Plus, Tempo's new high-profile hires. - 🗣️ Analysis: Super Bowl Predictions

Digging into the big game's volume data. - 🎧 Latest Pod: The MegaETH Era

Inside the road to mainnet and beyond.

p.s. Thanks to Kraken. Earn variable onchain rewards up to 8% APY with Kraken DeFi Earn. Automated, no wallets, no seed phrases, easy to use. Fees apply. Sponsor: Figure — Win $25k USDC with Democratized Prime.

. . . NEED TO KNOW MegaETH Is Live - 🐇 MegaETH Launches Public Mainnet. The new L2 has arrived with millisecond block times and a slew of major app integrations and new app deployments.

- 🏦 Farcaster's Founding Team Joins Paradigm-Backed Tempo Blockchain. The Merkle team is now developing with Tempo two weeks after leaving Farcaster.

- 📈 MrBeast Sets Sights on Financial Services with New Acquisition. Beast Industries just announced its acquisition of Step, a fintech company that wants to make money management accessible to all.

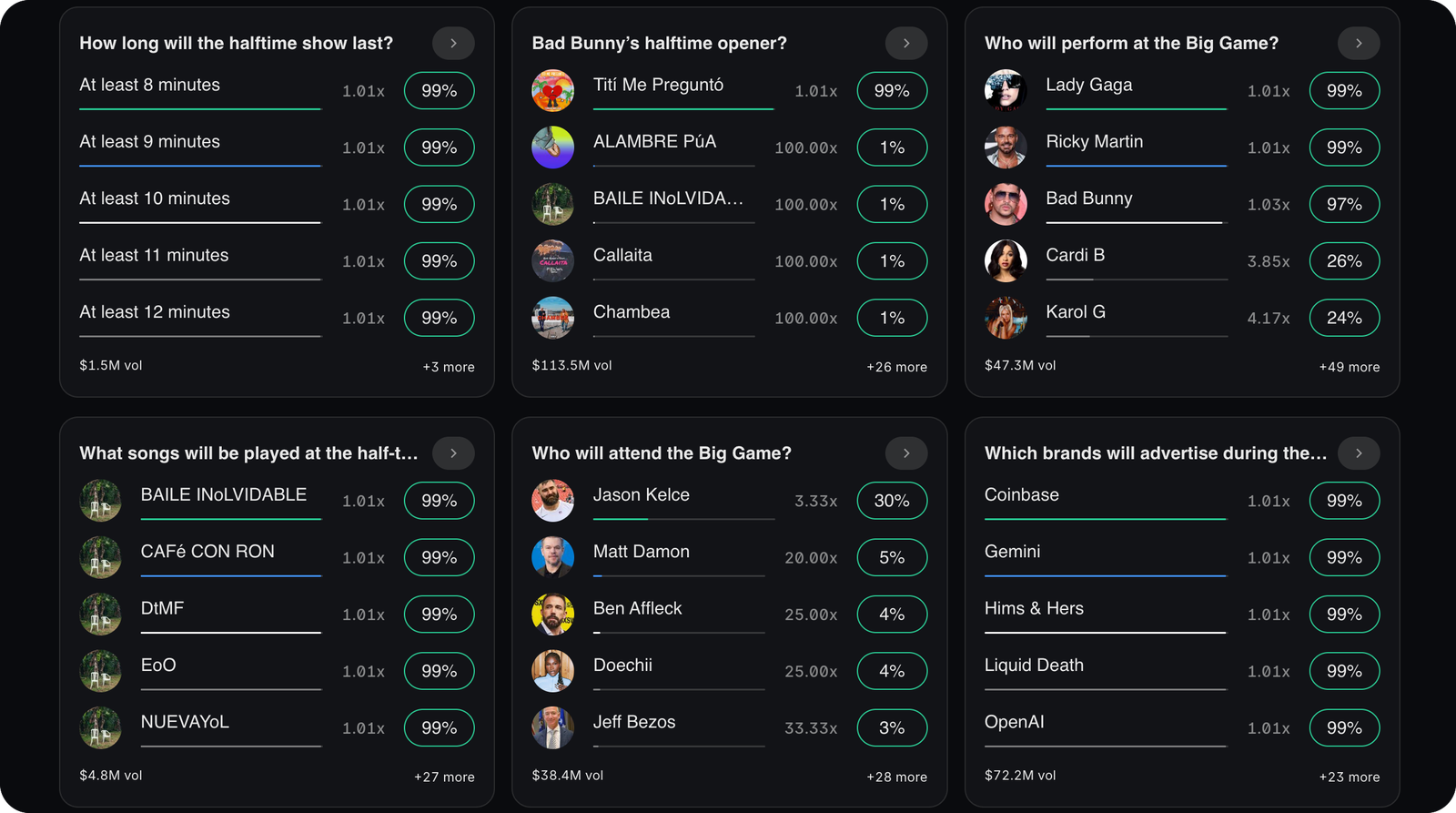

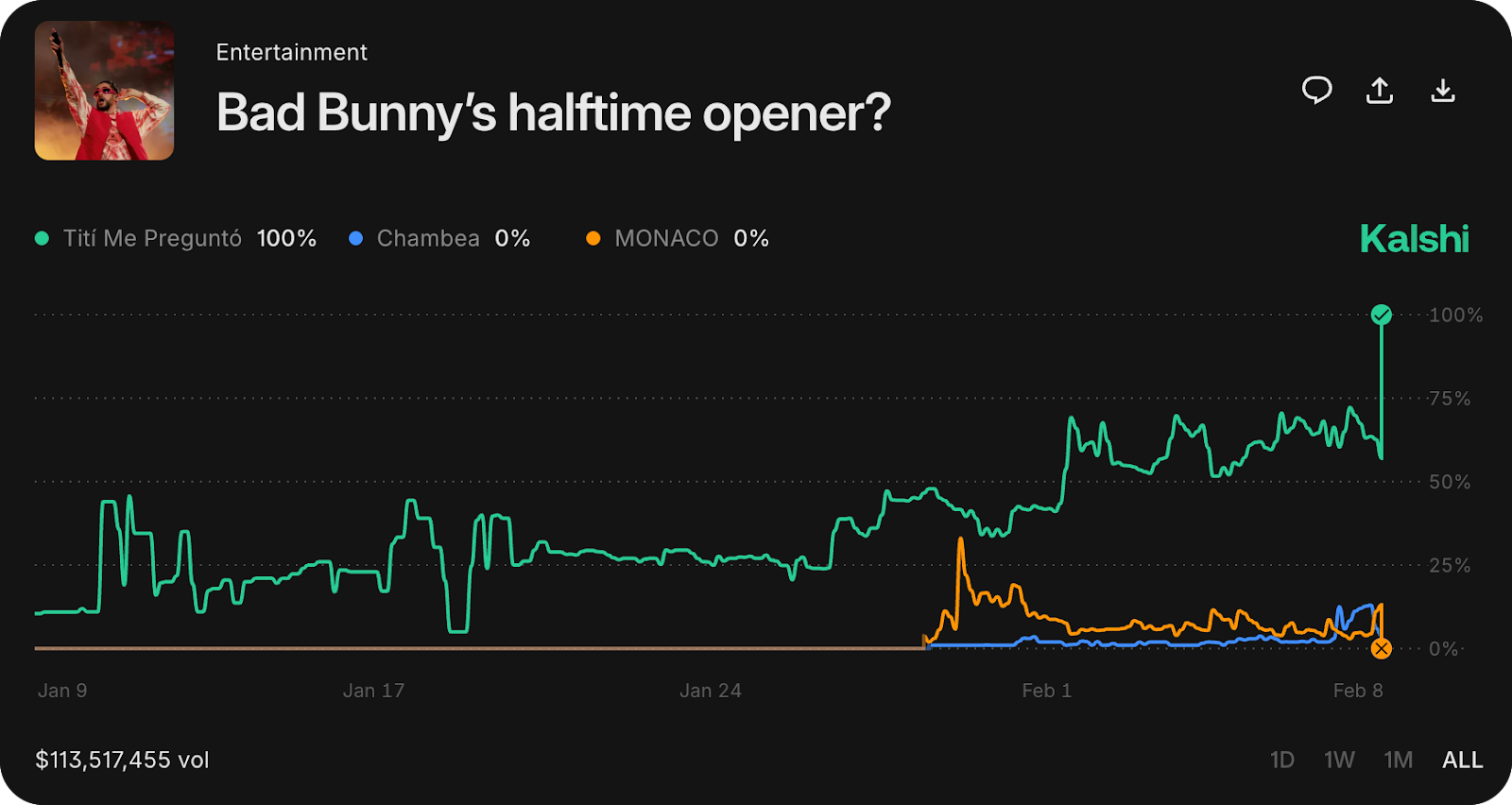

📸 Daily Market Snapshot: In what's been another meek day for the cryptoeconomy, the vast majority of the top 100 coins are trading barely in the red or barely in the green over the past 24 hours. | Prices as of 5pm ET | 24hr | 7d |  | Crypto $2.38T | ↘ 1.7% | ↘ 8.8% |  | BTC $70,001 | ↘ 1.4% | ↘ 10.6% |  | ETH $2,098 | ↘ 0.1% | ↘ 10.3% | . . . ANALYSIS Did Prediction Markets Win the Super Bowl? This year's Super Bowl — a Seahawks-Patriots matchup that lacked the celebrity gravity of last year's Taylor Swift-centric Chiefs-Eagles event — was the first where prediction markets were definitively forecasted to be competitors to traditional sportsbooks. Kalshi and Polymarket, the two largest prediction markets, both ran markets on and around the game, the halftime show, the ads, etc. And the preliminary numbers paint an interesting, if mixed, picture. A quick caveat before we begin: sportsbooks haven't reported their aggregate figures yet — that takes a few days. So this is a post-mortem working with projections on the sportsbook side and actual volume figures from prediction markets. Sportsbook Projections: Records, but Slower GrowthThe American Gaming Association projected ~$1.76B wagered with U.S. sportsbooks on Super Bowl LX, which would mark a record and a roughly 27% year-over-year increase. While the exact figures vary by source, most forecasts pointed in the same direction: another record, extending an eight-year streak of growth that kicked off after the Supreme Court's 2018 decision allowing states to legalize sports betting. But the growth is clearly decelerating. With 39 states plus D.C. already live, only Missouri joined this cycle — meaning the expansion-driven surges of prior years are giving way to incremental gains. Against this backdrop arrives prediction markets as another factor dampening growth. Ed Birkin of H2 Gambling Capital — (what a name) — told Fortune he estimated prediction markets would account for 80% of this year's year-over-year increase in total wagering activity, projecting $630M in prediction market volume across the event. Based on what we can see so far, prediction markets appear to have come in well short of that figure. KalshiKalshi's Super Bowl-specific markets — contracts tied directly to the game, the halftime show, and the broadcast — generated meaningful but not projection-level volume: Across these top markets, that's roughly $233M, well under the $630M that analysts projected for prediction markets as a whole. Separately, Kalshi's flagship NFL market — an open-for-months, season-long "who wins the Super Bowl" contract — pulled in over $500M in total volume. But that figure reflects the full arc of the NFL season rather than Super Bowl weekend alone, and even then, it amounts to less than a third of what sportsbooks were projected to handle for the Super Bowl alone. For months now, sports betting has accounted for the vast majority of Kalshi's total volume (90%+), benefiting from distribution equal and above that possible from sportsbooks. First, Kalshi's federal regulation through the CFTC means it’s directly available to U.S. users through its mobile app, just like sportsbooks. Pair that with substantial venture backing giving them a war chest for advertising, plus an integration with Robinhood, and Kalshi stands above the rest. This footing is paying off: Kalshi saw 1.9M downloads in January alone, compared to under 100K combined for DraftKings' and FanDuel's new prediction market apps, which both launched in December and are available in states where their traditional sportsbook apps aren't allowed. So far, traction has been minimal. DraftKings also struck a partnership with Crypto.com on Friday to expand its event contract offerings, signaling how seriously incumbents are taking the threat. PolymarketPolymarket's equivalent season-long NFL market did ~$700M in volume — larger than Kalshi's — though its Super Bowl-specific markets tell a different story. Polymarket's top three Super Bowl markets totaled around $76M: Polymarket lacks the regulatory approval Kalshi has in the U.S., meaning American users can't access it natively through a mobile app. Technically, Polymarket does now have a U.S. app after acquiring a CFTC-registered exchange last year — but it's still rolling out via waitlist, and its Super Bowl offerings were limited. As of a week before the game, the app had no sports markets listed at all, with the full slate of Super Bowl props only available on the global site. Instead, most U.S. users would still need to go through the website, use a VPN, etc. For a casual sports bettor, that's a non-starter compared to downloading Kalshi from the App Store. Where Polymarket did stand out, though, was its main use case — information discovery. Its halftime performer market had Lady Gaga sitting at roughly 80% for days leading up to the game — well before her surprise appearance during the halftime show, which Billboard had no prior reporting on and which genuinely caught everyone I was watching with off guard. The Regulatory BackdropAll of this is playing out against a regulatory clash that's still unresolved. Kalshi operates as a federally regulated exchange under the CFTC, which has allowed sports contracts to proceed — particularly since the new CFTC chair, Michael Selig, signaled he won't block them or cede oversight to states. State gaming regulators, who oversee sportsbooks, continue to go to court to challenge Kalshi and its peers, and many analysts expect these cases will eventually escalate to the Supreme Court. For now, prediction markets operate in a gray zone that gives them national reach without state-by-state licensing — a structural advantage sportsbooks can't easily replicate. The TakeawaySo did prediction markets live up to the hype for Super Bowl LX? Against the $630M projection, not quite. Across the top visible Super Bowl-specific markets on the two leading platforms, volume landed somewhere around $310M — roughly half the estimate. The season-long NFL markets did massive numbers on both platforms, but that volume accumulated over months of football, not Super Bowl weekend. That said, context matters. Kalshi's 1.9M January downloads dwarf the combined efforts of DraftKings and FanDuel's prediction market apps. And the pressure is showing up in stock prices. As Fortune notes, Flutter Entertainment, the parent company of FanDuel, is on an eight-week skid — its longest in 23 years. DraftKings is trading around its lowest levels since 2023, down over 60% from its all-time high. Fourth-quarter earnings estimates for Flutter have been slashed nearly 49% over the past three months, per Bloomberg, while DraftKings' estimates have dropped 29% over the same period. Imagine going to bet on DraftKings missing earnings on Polymarket. Prediction markets may not have conquered the Super Bowl overnight. But they've clearly arrived — and for sportsbooks, the trajectory should be concerning enough. FRIEND & SPONSOR: FIGURE Use Figure’s Democratized Prime for your chance to win big with $25k USDC. The more you participate, the better your odds! Every dollar gets you another chance to win $25K USDC. Enter to win while earning 9% yield on your crypto with Democratized Prime*. . . . LATEST POD Welcome to the MegaETH Era MegaETH just flipped the switch on mainnet, kicking off its bid for “real-time Ethereum” through its L2 purpose-built for ultra-low latency apps. Accordingly, MegaETH founders Lei Yang and Namik Muduroglu just joined David and Ryan on the podcast to unpack what it took to get here, including a mainnet stress test that hit 55,000 TPS. The group also talks through Vitalik's latest L2 commentary, the "Ethereum barbell" thesis, scaling the USDM stablecoin flywheel, and more. Catch it all in the full episode! 👇 |

No comments:

Post a Comment