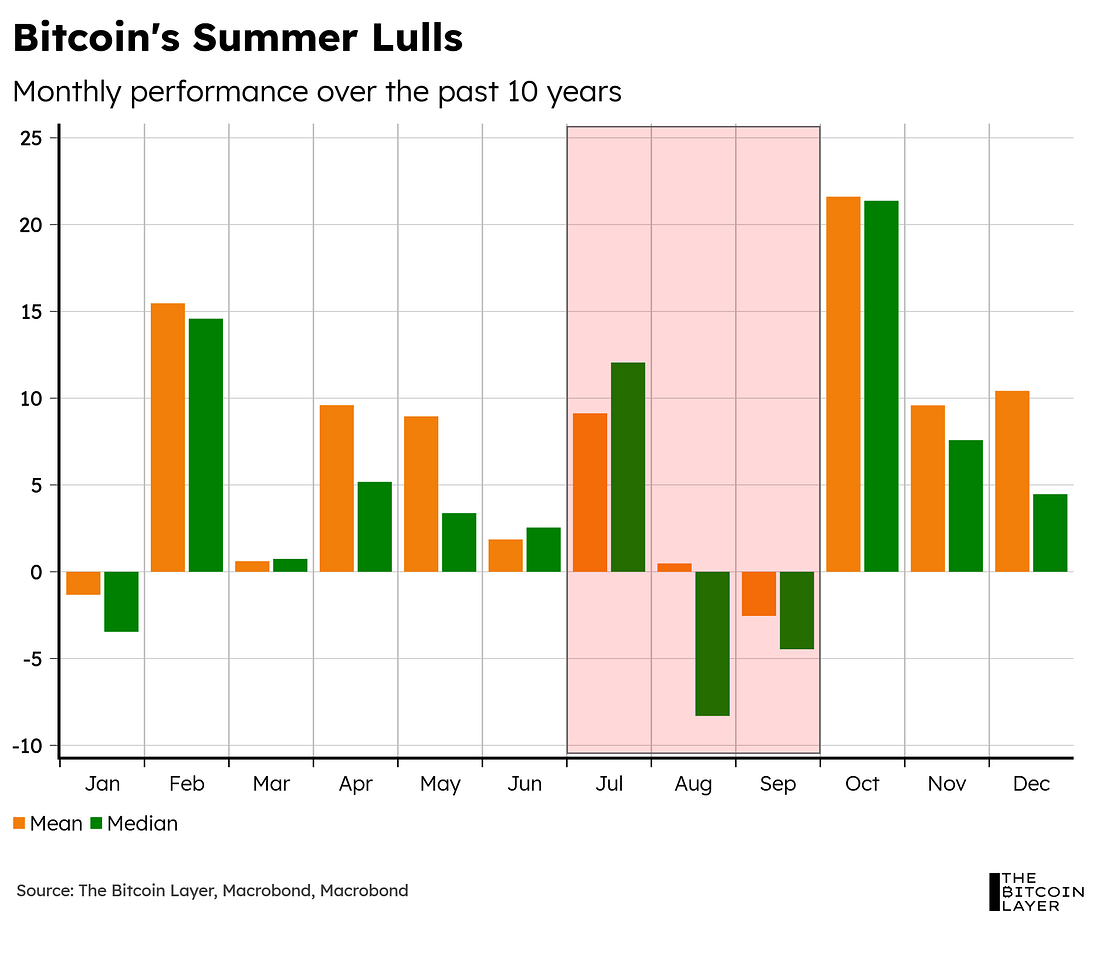

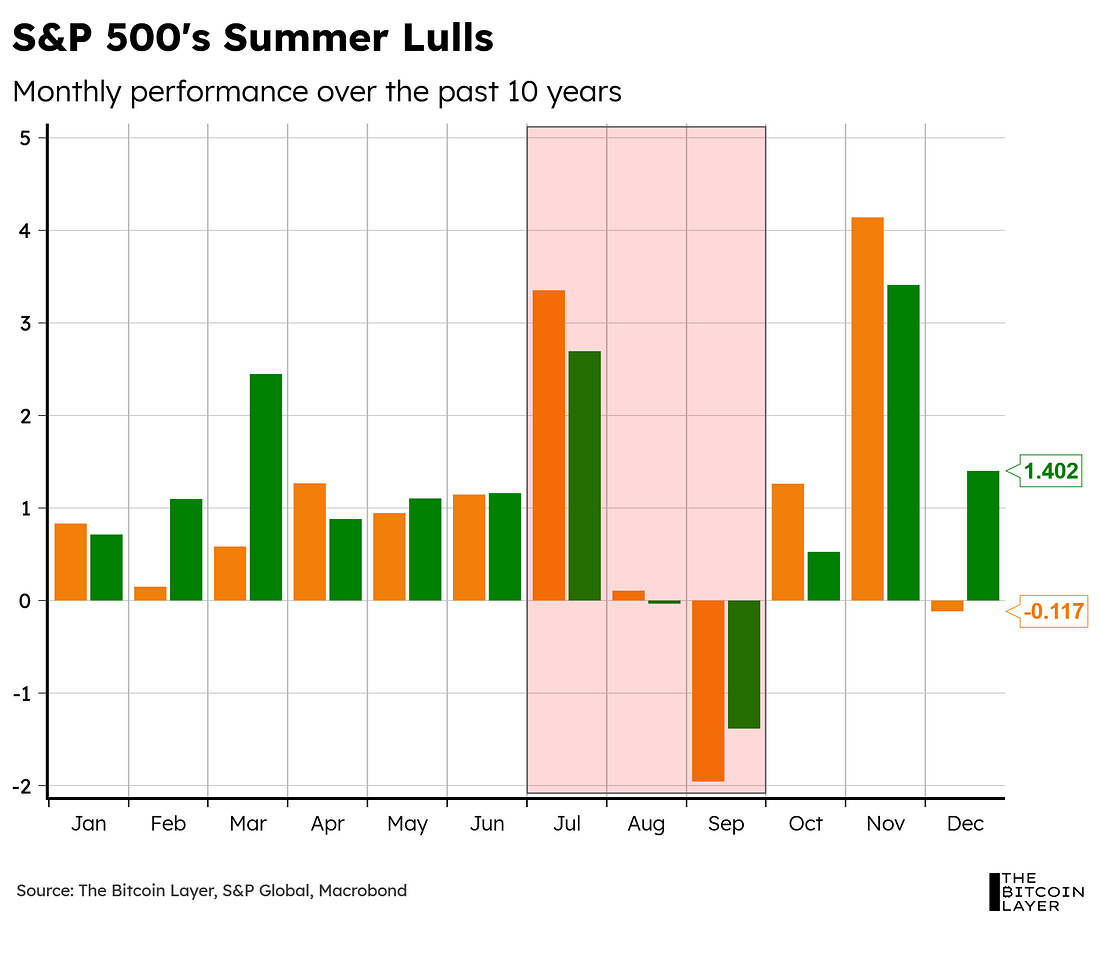

Dear Readers, We’re approaching the middle of the summer already, which typically means quieter times in financial markets (Summer Lulls - charts below). But this is no ordinary year, and although this past week didn’t have hard economic data to trade on, the White House maintained its bulldozer approach (just ask hard-hat Jerome Powell about it). The most important takeaway from the week was that the stock market hit another all-time high, and risk investors love the US-Japan alliance and what it signals for US tech and industry going forward. Historically, risk has performed well in July, but then slows down in the middle to the end of the summer: This historical pattern has held pretty well so far this year—happy July: Which makes us slightly biased toward the expectation that August will follow these historical patterns, with risk assets performing as they have in previous years (consolidation or slowdown). In today’s article, we will continue to build our narratives and expectations for what’s left of this year. Namely:

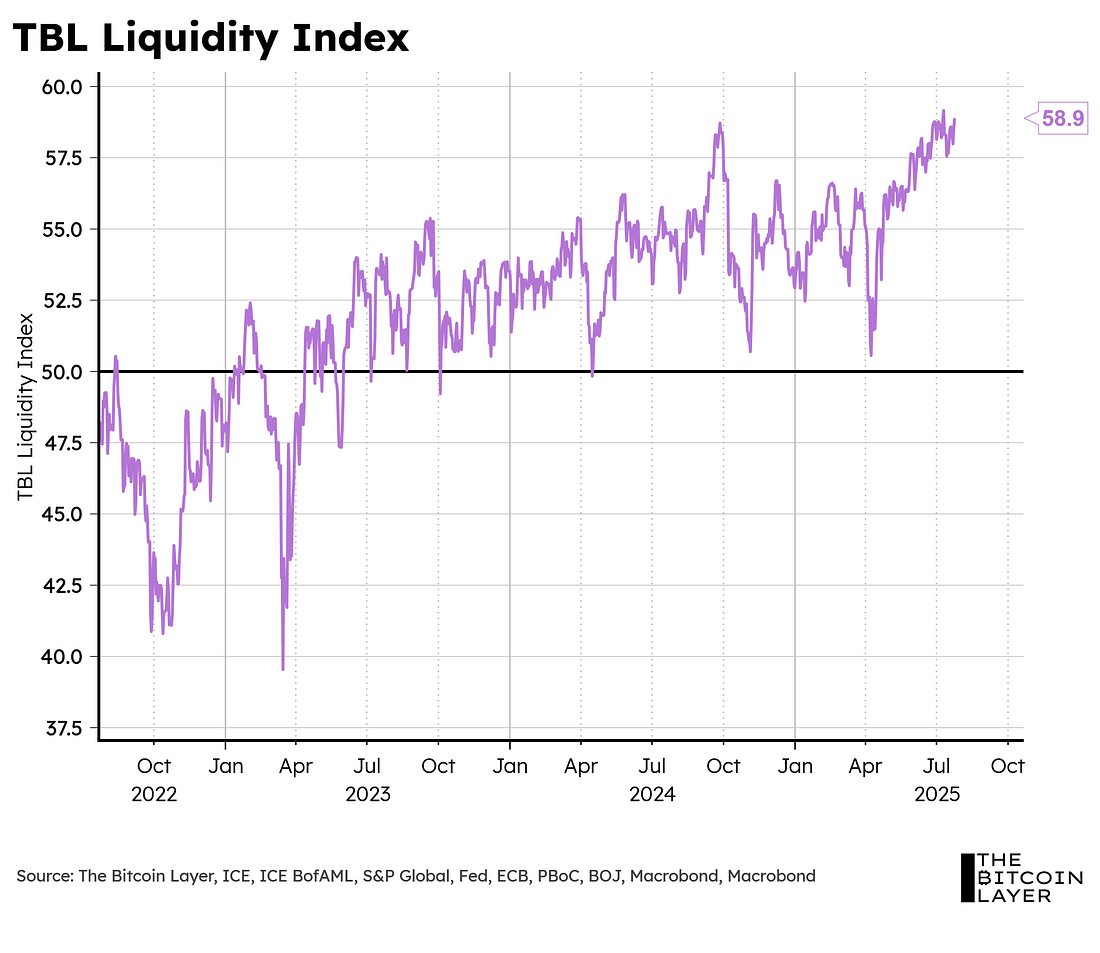

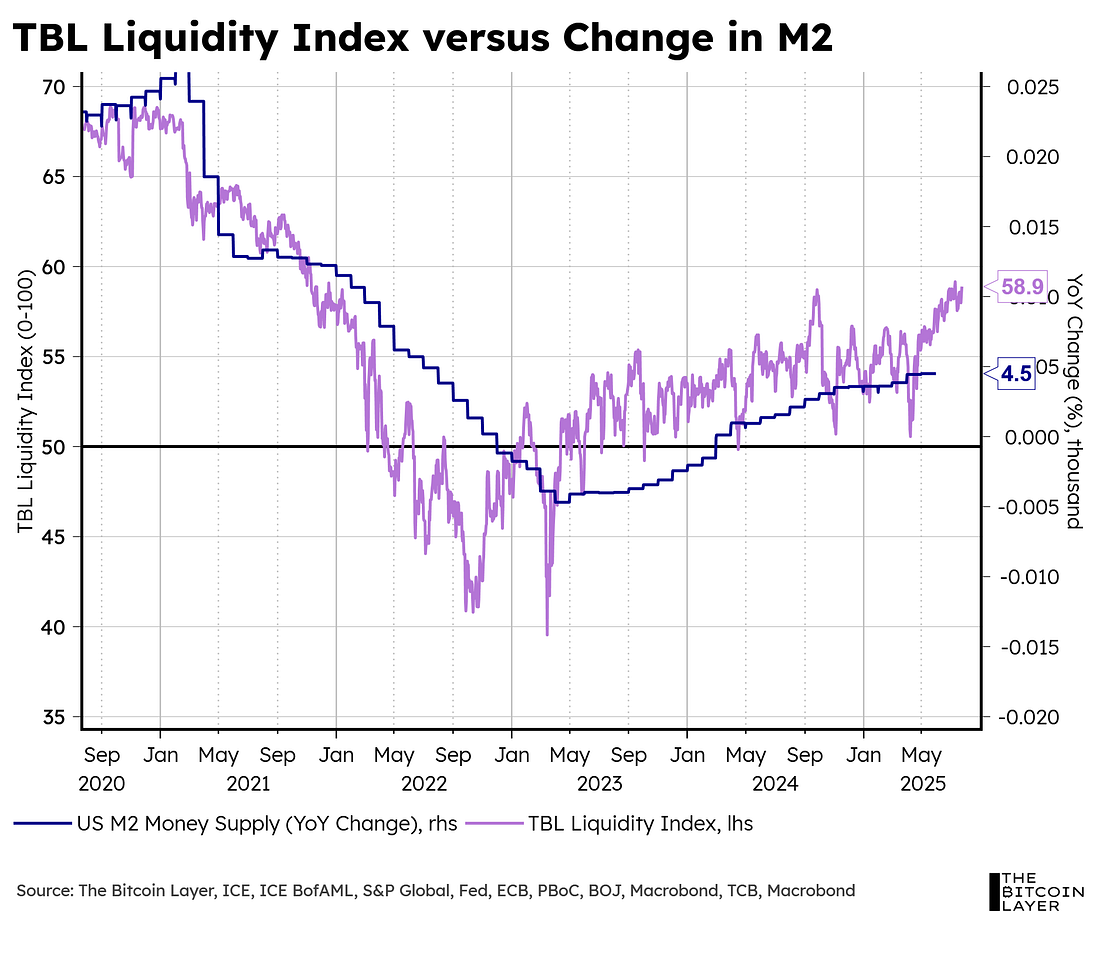

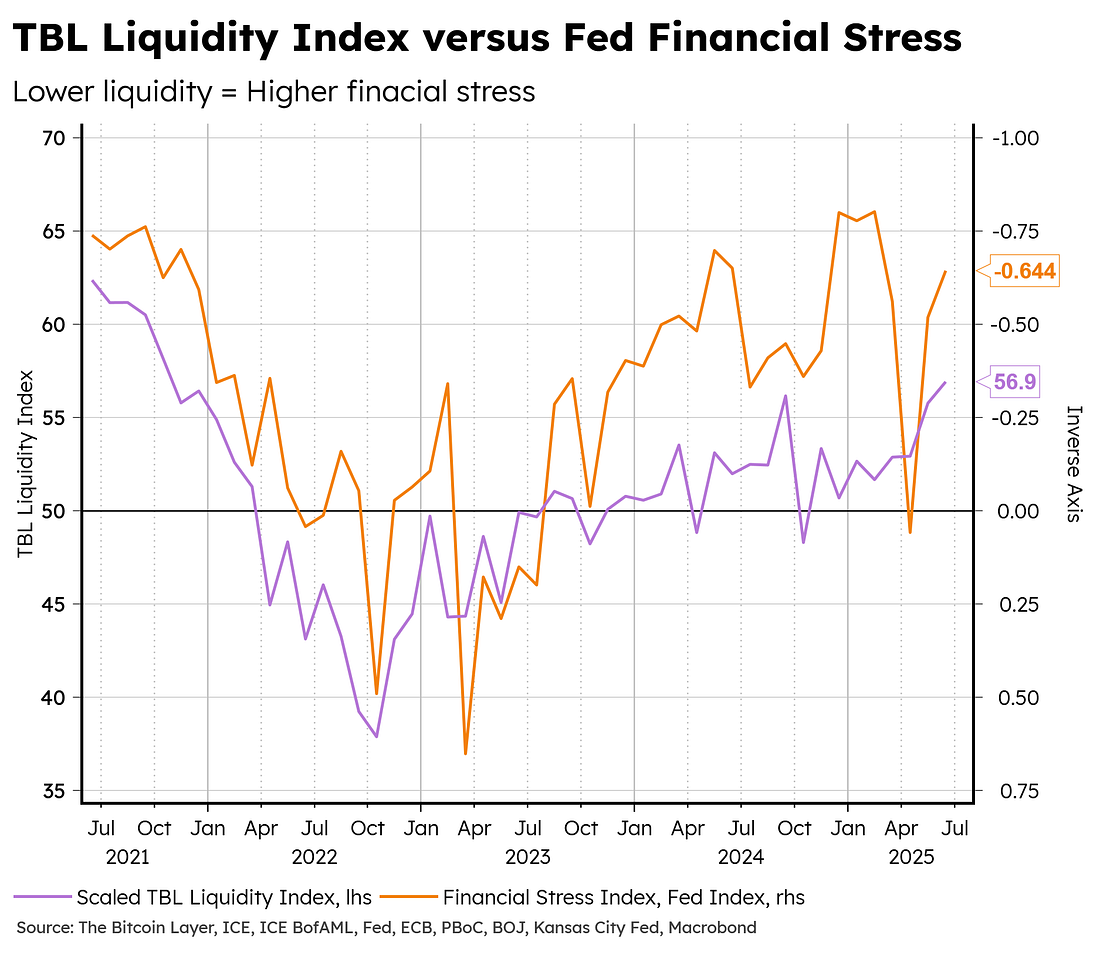

So, without further ado, let’s dive into TBL Weekly #150. Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk. Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys. Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account. The Financial Freedom Report is a weekly newsletter from the Human Rights Foundation (HRF) that tracks how authoritarian regimes weaponize money to control their populations and suppress dissent. It also spotlights how freedom technologies like Bitcoin are helping everyday people reclaim their financial independence and freedom. A one-of-a-kind newsletter connecting the dots between financial repression, geopolitics, and emerging tech. Smart macro analysts don’t just watch the Fed. They watch the world. Our videos are on major podcast platforms—take us with you on the go! Keep up with The Bitcoin Layer by following our social media! Weekly AnalysisTBL Liquidity IndexThis past month, we’ve had some new subscribers join the community, so we want to hit a quick refresher here: As the name entails, our TBL Liquidity Index gauges liquidity currently in the financial system by incorporating US dollar strength, banking assets, and overnight funding collateral strength (read US Treasuries and bond volatility). As it turns out, our index is a fairly strong measure of liquidity in the system. When paired up against ‘official’ and ‘traditional’ ways of measuring liquidity, it moves exactly the same. TBL Liquidity moves alongside yearly changes in M2 money supply: And whenever TBL Liquidity is low, financial stress, as measured by the Kansas Fed Stress Index, is higher: This metric has become extremely important to our framework because it draws an almost identical line with risk assets. Since Liberation Day in early April, TBL Liquidity has almost mirrored the S&P 500’s V-Shaped recovery:... Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Friday, July 25, 2025

An Important TBL Liquidity Refresher: TBL Weekly #150

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Bitcoin's Hidden Strength: Why 2025's Pain Signals a 2026 Bottom ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The future of onchain real-world assets is a winner-takes-most game, but who are the contenders besides Ethereum? ...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Our bi-weekly quantitative risk report for TBL Pros: December 17th, 2025 Edition ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

It's the time of year that Bankless busts out the crystal ball. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment