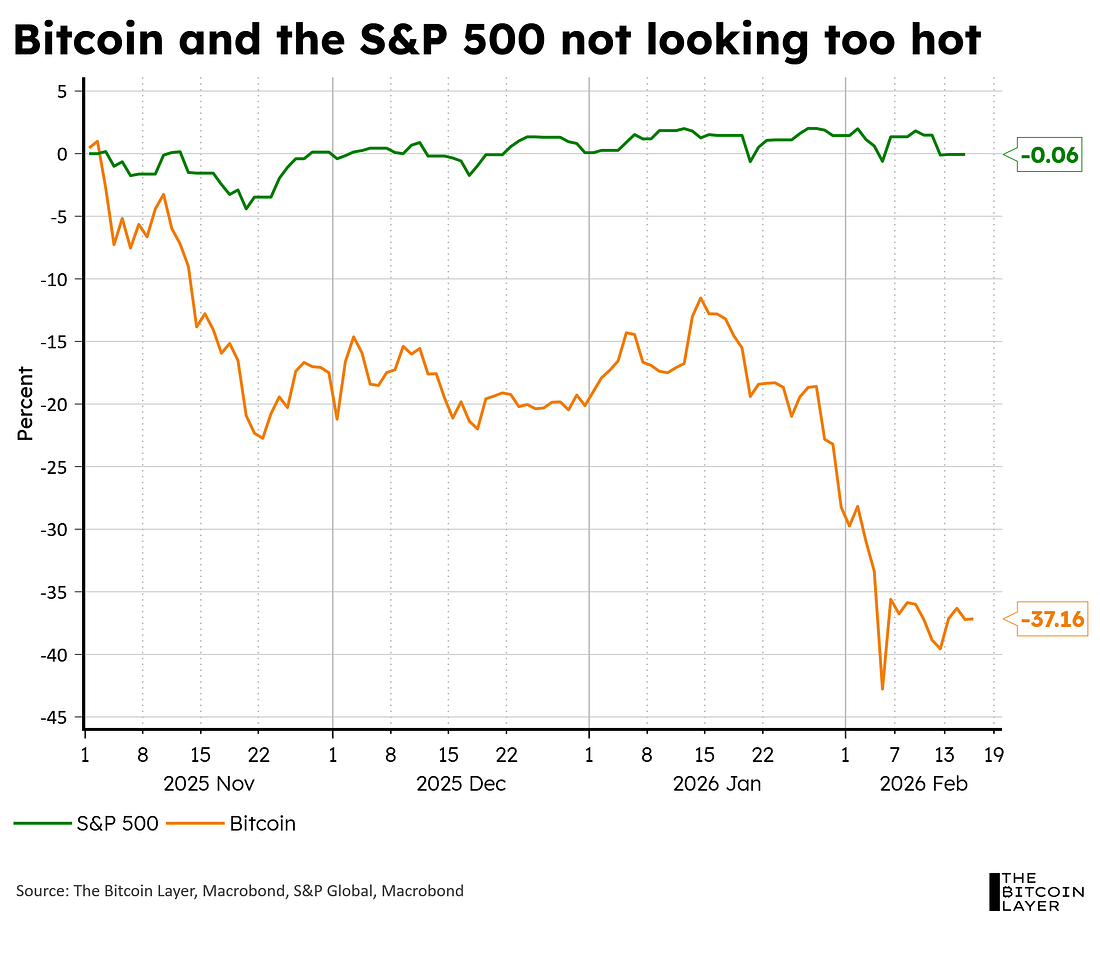

A Century Packed Into Half a QuarterAccess to our latest Q&A recording with Checkonchain at the end of this articleDear Readers, Halfway through Q126, and it feels like markets have had to digest a century of information. Just a few months back, sensationalists were screaming that the financial system was on the brink of collapse because overnight rates were popping above Fed targets and the standing repo facility was being utilized to meet liquidity needs. Paraphrasing the overall sentiment back then, it went something like, “printing is coming, and with it, sky-high asset prices.” Of course, none of that happened...imagine our shock. In fact, quite the opposite. Bitcoin is down nearly 40%, while the AI-concentrated S&P 500 is basically flat since late last year (chart below): But alarmists didn’t stop there… The foundations of money are shifting in ways that are easy to feel but harder to name. Persistent deficits, rising debt, and central bank behavior are quietly reshaping how investors think about preservation and risk. In The Debasement Trade, James Lavish explains why currency debasement is structural, why traditional portfolio assumptions are being tested, and why gold tends to move first while bitcoin often moves further as the implications compound. The report covers:

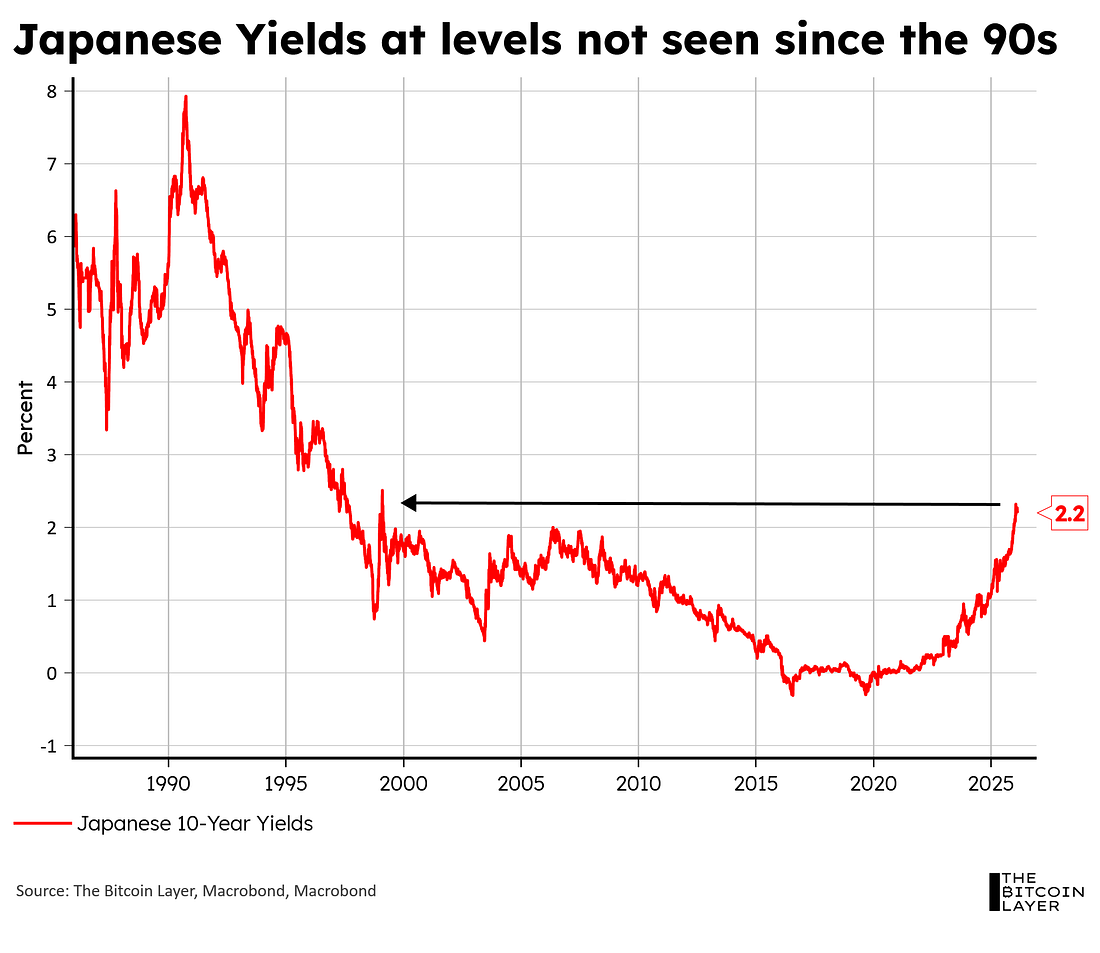

A few months later, we saw another story pop up and create noise across different headlines: Japanese Government Bonds (JGBs). Upon increased fiscal concerns due to stimulative policies from Takaichi’s new government, we saw Japan’s 10-year yields shoot up to levels not seen since the dotcom era: This led many to become quite bearish on asset prices for multiple reasons, with the main ones being:

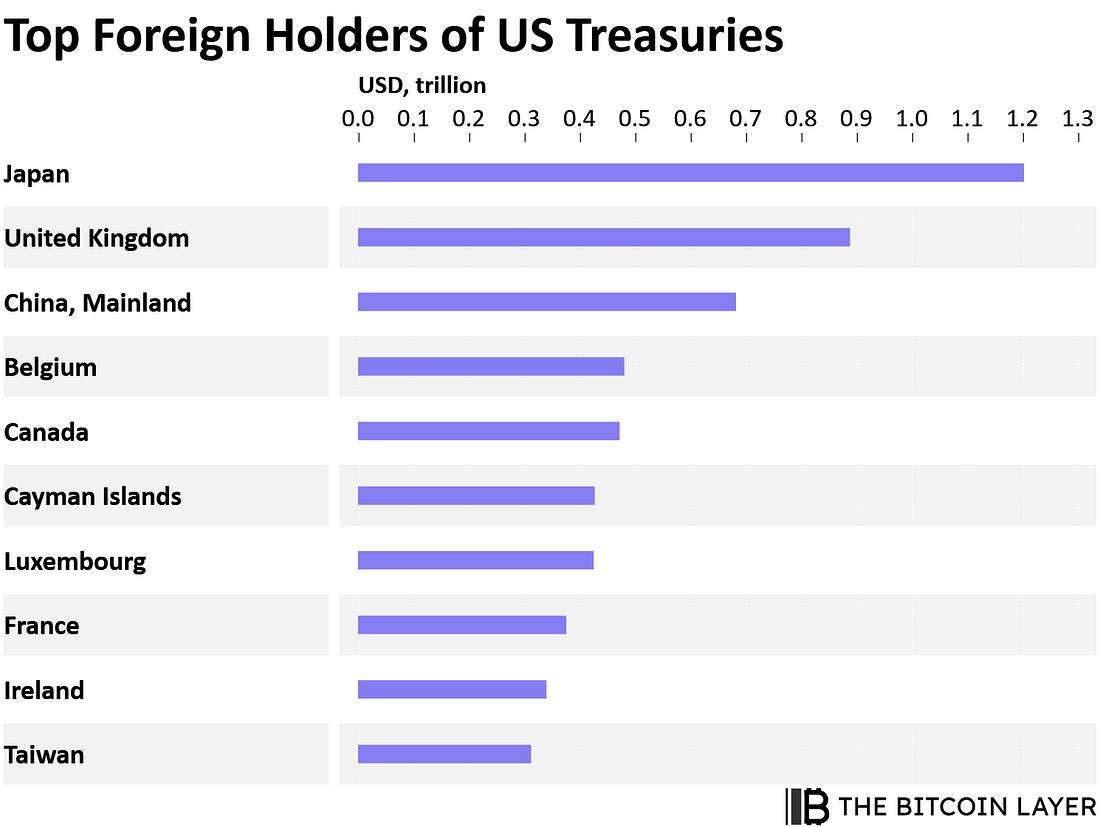

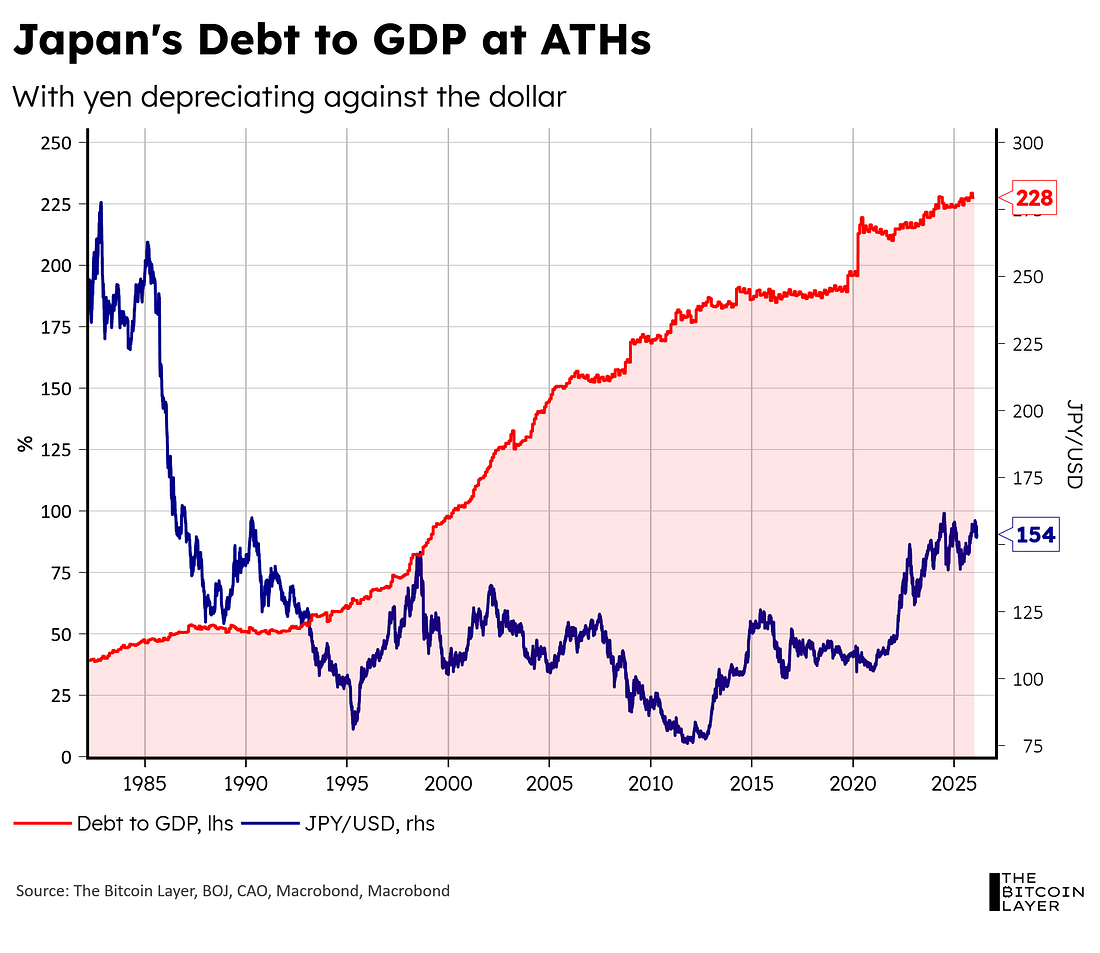

Although it’s still too early to run laps around doomers, we try our best to remain as stoic as possible when these headlines hit the tape. Our narrative on the Japanese story basically holds hands with what Lyn Alden discusses in her latest newsletter: not only can Japan phone the US (something we discussed here), but they are also the largest foreign holders of US Treasuries (chart below—something we discussed here): Many are concerned about printing yen to buy JGBs as the only way to backstop yields from rising, amidst its highest debt-to-GDP level (chart below): However, there are ways to avoid such yen depreciation if the Japanese central bank were to perform more YCC. Japan has enough USTs to defend its currency by selling American debt and buying back yen. As Alden puts it:

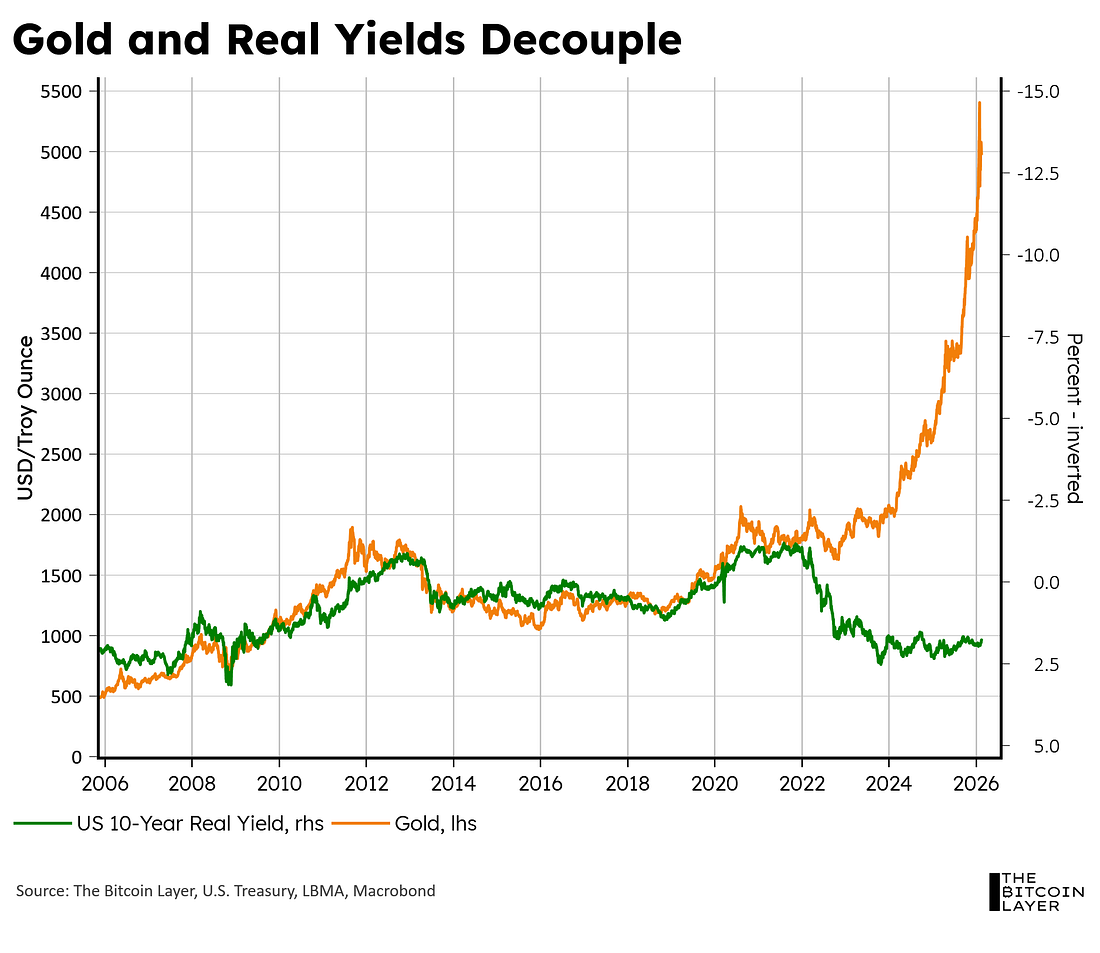

All that to say (and at the risk of being called permabulls), these momentary ubiquitous headlines and narratives have little effect on our overall bullish stance for risk this year. Staunch American ally Japan dumping Treasuries is absolutely in the realm of outcomes, but we place a lower probability on it, given recent FX management rumors between the two countries. However, we are also not blind to what‘s going on. We are seeing anomalies left and right. One such anomaly is what’s going on in precious metals. Historically, when interest rates fall, there is increased demand for non-yielding assets like gold, as the opportunity cost of holding them is lower. That said, since 2022, that relationship has completely broken down (chart below - inverted horizontal axis on the right): Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Wednesday, February 18, 2026

A Century Packed Into Half a Quarter

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Also This Is a Correction for Some Assets, a Bear Market for Bitcoin & Bitcoin Is Trading as a Risk-On Asset, Not a Defensive One ͏ ...

-

Can incumbents compete with the big banks? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

-

The Ethereum Foundation is making big changes to its leadership team. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

-

Learn why crossings in 30-day vs. 60-day hash rate averages reveal real operational decisions by miners—and historically predict strong Bitc...

-

Macro we can learn from bitcoin's latest obituary ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment