A Sharp Reset for Bitcoin MinersBiggest Difficulty Drop in Years + Puell Multiple Flashing Stress – BTC Reset UnderwayWhat’s HappeningPrice ActionIt has been a particularly volatile week for Bitcoin, with BTC price briefly tumbling as low as $60,000, before stabilizing back up around $70,000. Currently, BTC is down 8.23% over the past week. Figure 1: Another volatile week for Bitcoin. The move last week was a capitulation, coming after sustained selling over the past 3 months that has seen BTC lose more than 30% of its value as panic has ripped through the market. Figure 2: BTC past 3 months’ performance. At Bitcoin Magazine Pro, we note that BTC came very close to reaching two major support levels last week:

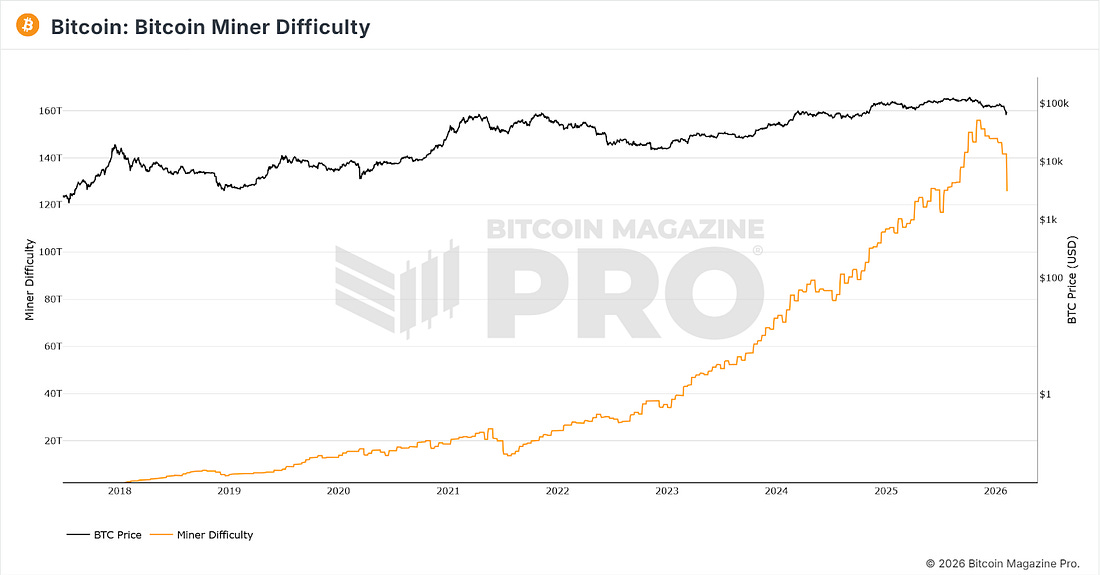

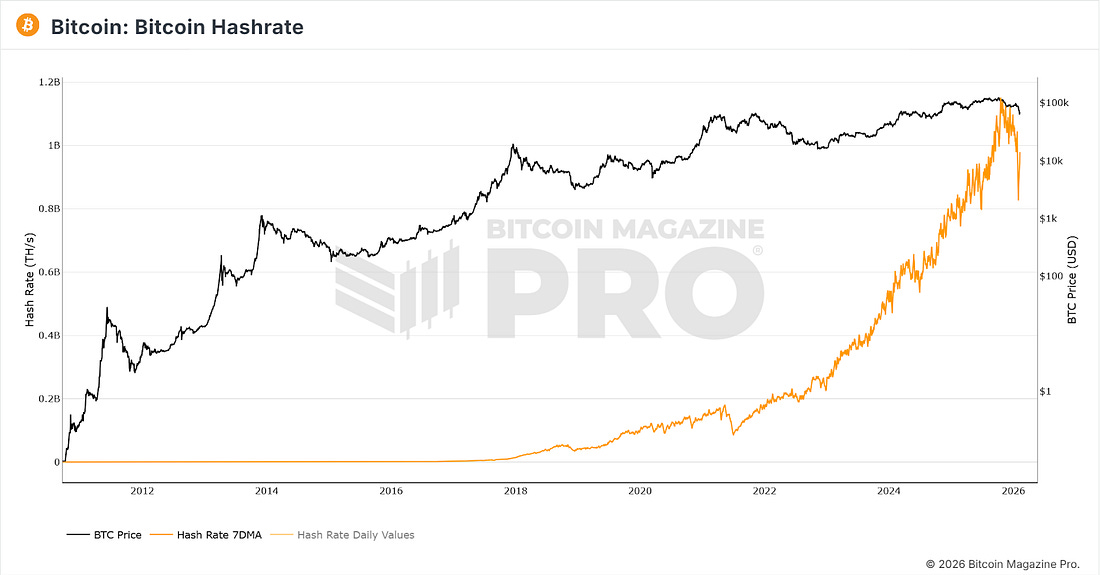

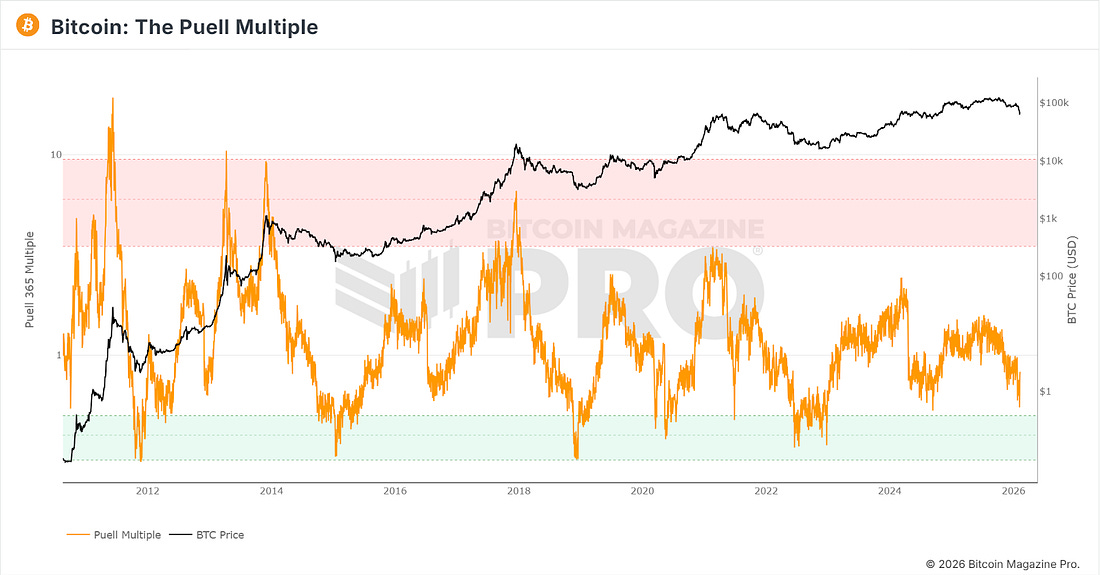

Figure 3: BTC approaching major support levels. In previous bear markets, BTC has reached and spent some time at or below these two levels. It remains to be seen whether BTC price will drop below them again - or whether this time is different. We discuss this in much more detail with our platform subscribers. You can subscribe here. The Big Story: A Sharp Reset for Bitcoin MinersBitcoin’s mining landscape has just experienced one of its most abrupt resets in years. At the latest difficulty retarget, mining difficulty fell by 11.16%, dropping to 125.86 trillion. This was the largest negative adjustment since mid-2021 and ranks among the steepest difficulty declines in Bitcoin’s history. In practical terms, blocks had been taking significantly longer than the 10-minute target, which reflected a sudden reduction in active computing power across the network. Figure 4: Major drop in mining difficulty. That slowdown is clear in the hashrate data. Over the past month, total network hashrate has fallen by roughly 20%, with a particularly sharp pullback in recent weeks. After reaching record highs late last year, hashrate has retraced quickly as miners respond to weakening economics and temporary power disruptions. Figure 5: Hashrate drop. Price has been a major pressure point. Bitcoin’s drawdown from recent highs has compressed miner margins sharply, pushing hashprice, the revenue earned per unit of hashpower, to fresh all-time lows. At current levels, only the most efficient next-generation machines, most notably the Antminer S23 series, are generating healthy returns. Many older rigs are operating close to break-even or at a loss. The Puell Multiple adds further context. It measures daily miner revenue relative to its 365-day average, making it a useful gauge of miner profitability and stress. When it approaches the green zone, it signals that miners are earning significantly less than their historical norm, a condition that has often coincided with late-stage sell-offs and network rebalancing. Figure 6: Puell Multiple As shown in the chart above, the metric is now approaching its historical green zone. In past cycles, this area has coincided with periods of miner stress, capitulation, and eventual network rebalancing. Lower difficulty provides some immediate relief for miners that remain online, but the sustainability of that relief ultimately depends on where BTC price goes from here. For now, the data suggests the network is working through a necessary, if painful, adjustment. To view all of these charts and receive more in-depth analysis, subscribe to the Bitcoin Magazine Pro platform here. The Bitcoin Magazine Pro Team. Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else. We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Monday, February 9, 2026

A Sharp Reset for Bitcoin Miners

Subscribe to:

Post Comments (Atom)

Popular Posts

-

How Bitcoin was born to end reliance on broken systems and deliver the world’s first truly scarce digital money ͏ ͏ ͏ ͏ ...

-

From Treasury Titan to Distress Sale? MSTR Down 53% in a Year Amid Extreme Fear ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Biggest Difficulty Drop in Years + Puell Multiple Flashing Stress – BTC Reset Underway ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

In the last newsletter, I had listed the many bearish factors in the market. The dip kept dipping. But there are s...

-

Why short-term moves matter less than the big picture ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment