Bitcoin Is Vulnerable To Another Leg DownAlso Bitcoin’s Volatility Compression Confirms Structural Change & No Hawkish Pivot From The Federal ReserveWelcome to Ecoinometrics’ Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we’ll cover:

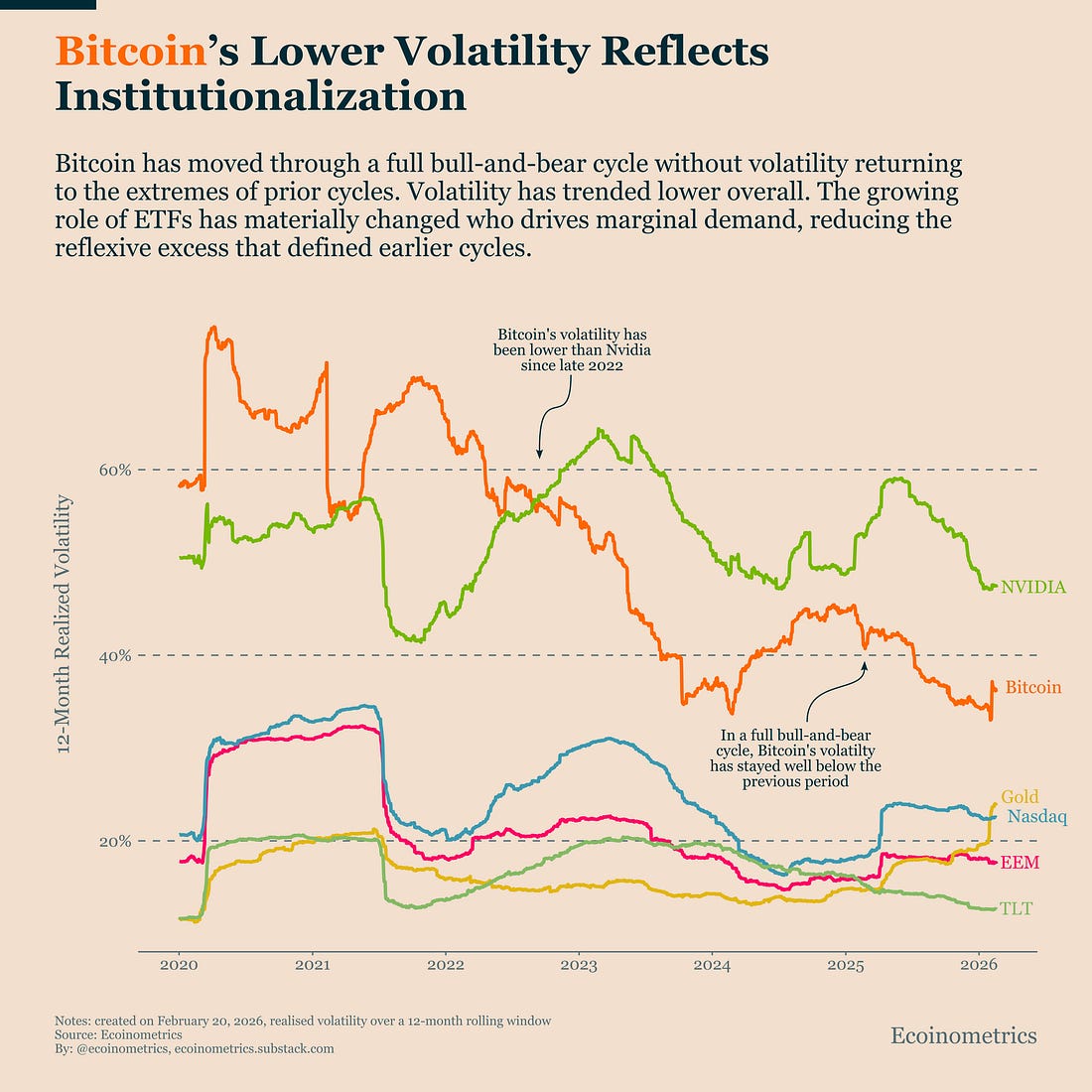

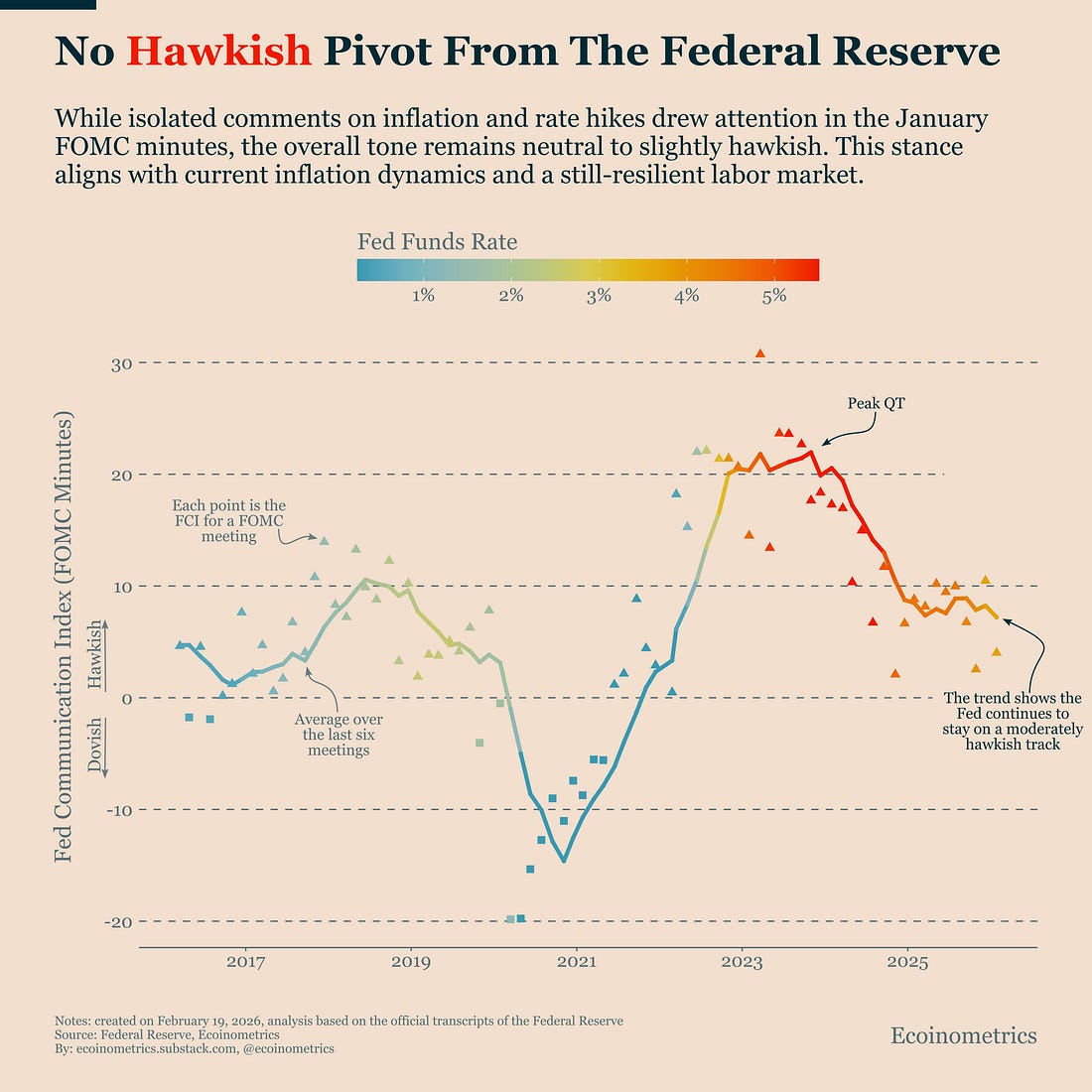

Bitcoin doesn’t trade on its own anymore. It’s tied to equities, tied to flows, and sensitive to macro conditions. Right now, Bitcoin is already weak, equities are slowing, and the Fed is steady but not supportive. That combination keeps the balance of risk tilted lower. In case you missed it, here are the other topics we covered this week: Get these professional-grade insights delivered to your inbox: Bitcoin Is Vulnerable To Another Leg DownBitcoin has been trying to stabilize, but this is not a guaranteed bottoming structure. It’s more likely to be a pause inside a bear market. We already have persistent ETF outflows. We already have a risk-off correlation regime. Those are structural headwinds. But there’s another problem building quietly in the background: U.S. equities have started to lose momentum. Look at the chart. Bitcoin is clearly below its long-term trend. The 200-day moving average has rolled over and rallies keep failing beneath it. That’s what a bear phase looks like. There is no hidden risk in that pattern. But the Nasdaq 100 is different. Price has stalled for about three months, but the 200-day moving average is still rising. That means equities are not yet in a structural downtrend. It’s a slowdown without a breakdown so far. Now, when Bitcoin is weak on its own, it can grind lower. But when equities join in, it doesn’t grind, it drops. That’s what happened in 2022. Once the Nasdaq lost its long-term trend, every risk asset moved together. Right now we have an unstable setup: Bitcoin is already in negative momentum while the broader risk complex is still holding up. If the Nasdaq rolls over decisively, Bitcoin will not be spared just because it is already down a lot. There is no historical example of tech entering a real bear phase while Bitcoin quietly stabilizes. Let me stress the key point: Bitcoin being “already down a lot” does not protect it from another wave of selling. On balance, the risk still points lower. Until equities either re-accelerate or clearly break, Bitcoin remains exposed. This is not an environment to increase exposure. Bitcoin’s Volatility Compression Confirms Structural ChangeThe risk we discussed in the previous section isn’t happening in a vacuum. Bitcoin itself has changed. That’s very clear in its volatility profile. In the previous cycle, Bitcoin’s 12-month realized volatility exploded during both the bull phase and the collapse that followed. This time, we have gone through a full bear-bull-bear trip since 2022 and volatility never returned to those extremes. Peak volatility in this cycle has been materially lower. Since late 2022, Bitcoin’s volatility has even fallen below Nvidia’s, something that would have sounded absurd a few years ago. That is not coming out of nowhere. It reflects who is driving marginal demand. ETF flows now dominate trend formation. They are larger, steadier, and more systematic than the reflexive retail waves that defined earlier cycles. Whale flows still matter, but they no longer overpower the tape the way they used to. You can see it in short-term volatility distributions losing their extreme right tail. And you can see it in long-term realized volatility compressing across an entire cycle. Bitcoin is now rarely trading like a detached speculative instrument. It is embedded in institutional portfolios, sitting alongside tech and growth equities. That has clear upsides. Lower volatility. Cleaner flow signals. Greater durability. But it also has negative consequences. If Bitcoin is embedded inside the risk-on complex, it will behave like a member of that complex. That means deeper sensitivity to equity drawdowns than in prior cycles. Institutionalization makes Bitcoin stronger structurally. It also makes it less independent. No Hawkish Pivot From The Federal ReserveThe January FOMC minutes came out this week, and some of the commentary made it sound like the Fed had suddenly shifted back into tightening mode. That’s not what happened. We run every set of FOMC minutes through our natural language model to generate a Fed Communications Index, a score that captures the overall hawkish or dovish tone of the text. This method, instead of focusing on individual dramatic sentences, focuses on the aggregate message. That’s a much more stable way of analyzing tone drift over several meetings. And the latest minutes scored slightly hawkish. But that’s exactly where the Fed has been for the past six to eight meetings. There is no new escalation. There is also no pivot. The Fed is still in the same posture: inflation progress has been made, but it’s not fully won. The labor market is still resilient. That means rate cuts are not urgent, and rate hikes are not imminent either. The communication trend confirms it. The index remains well below the tightening peak of 2022 and far above the crisis-level dovishness of 2020. We are in a middle zone. For Bitcoin, that’s not all bad. A steady Fed is not a tailwind. But it is also not an active headwind. The current stance removes the risk of sudden policy shock, which is important in an already fragile market. Nothing changed in January. And sometimes, in a nervous market, stability is the most important signal. Tactical TakeawayBitcoin is already in a bear phase, and it is now structurally tied to the broader risk complex. If equities weaken further, Bitcoin will likely follow. And there is no policy pivot coming to offset that risk. This is not the time to press exposure. Wait for either renewed equity strength or a proper washout. Acting in the middle might costs more than it rewards. That’s it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, February 20, 2026

Bitcoin Is Vulnerable To Another Leg Down

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Ethereum's zkEVM is going to be huge; here are the technical efforts that will harden its impact. ...

-

Ethereum Lookin' Good Here EF Leadership Joins the DAS Lineup ...

-

Bryan's $1M service product, analyzing MegaETH's lackluster performance, LayerZero announcement of blockch...

-

Learn why crossings in 30-day vs. 60-day hash rate averages reveal real operational decisions by miners—and historically predict strong Bitc...

-

Access to our latest Q&A recording with Checkonchain at the end of this article ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment