| gm Bankless Nation,

Ethereum's zkEVM is going to be huge; here are the technical efforts that will harden its impact. Today's Issue ⬇️ - 🗣️ Analysis: Ethereum's Technical Leaps

The tech powering its leaner future. - 🎧 Latest Pod: The 'Gradual Print' Era

Lyn Alden tackles our current macro monetary moment.

Sponsor: Ready — Spend USDC worldwide with zero FX fees and up to 3% cashback.

. . . ANALYSIS The Technical Leaps Hardening Ethereum's zkEVM Future As Ethereum reorients away from rollup-centrism and back toward L1 scalability, work on three interconnected upgrades has ramped up considerably over the past few weeks – promising a more performant future that doubles down on the values that distinguish Ethereum. - Rapid zkEVM progress

- Post-quantum security

- Client-side proving

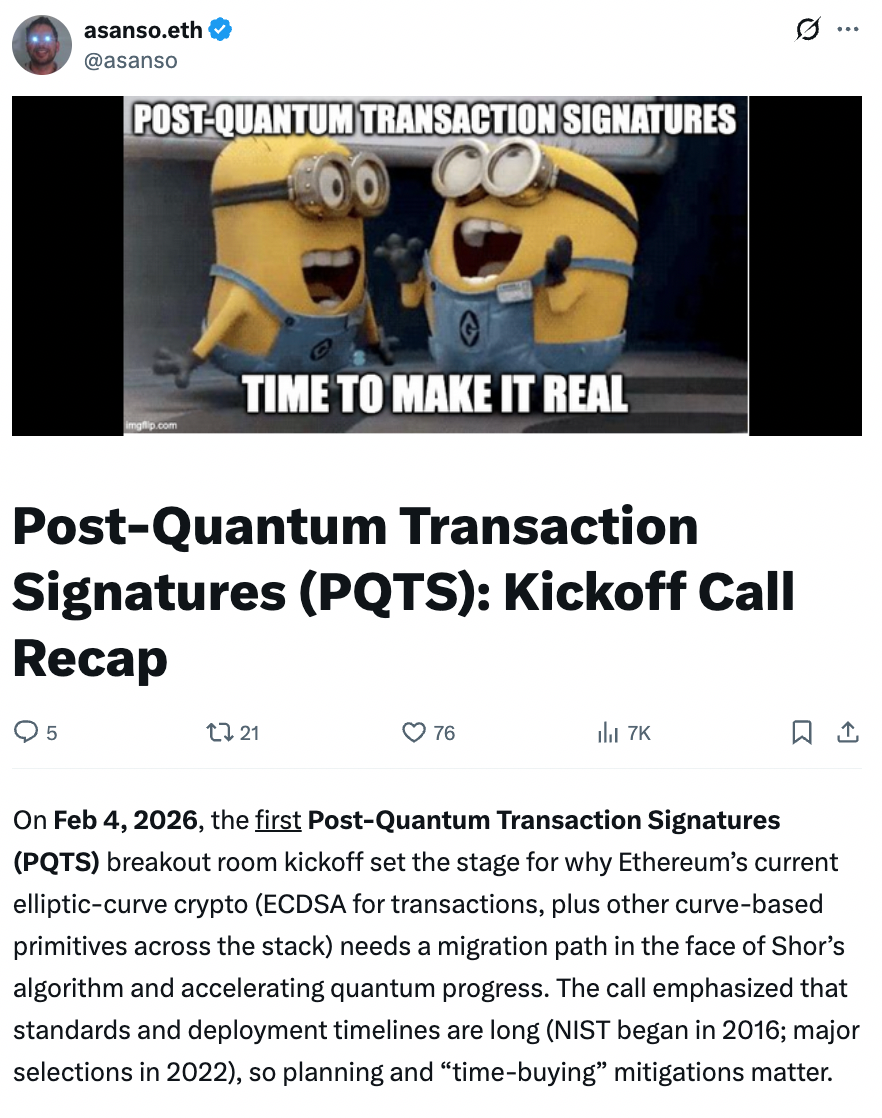

Each upgrade has made material progress recently, with 2026 poised to be the year they get delivered! Here's where each stands and how they fit together for a brighter future for Ethereum and the world. Shipping the zkEVMThe ecosystem is still digesting Vitalik's recent declaration that rollup-centrism "no longer makes sense." But if rollups are no longer Ethereum's north star, what is? As our very own David Hoffman recently wrote, the answer is clear: it's the zkEVM. In January, Tomasz Stańczak published the Ethereum Foundation's zkEVM roadmap for bringing zero-knowledge proofs to L1 block validation, targeting this year to tackle its core infrastructure. Today, when validators check that a block is valid, they re-execute every transaction themselves, doing the same work the block producer already did, thousands of times over across the network. It's a fundamentally inefficient process that constrains every blockchain, even Solana. The zkEVM changes this: instead of re-executing, validators would verify a cryptographic proof confirming the block was processed correctly. The same confidence with far less work. This effectively turns the L1 into a ZK rollup – the very thing Ethereum spent years building externally via L2s, now internalized. The user impact is direct: with proof verification far cheaper than re-execution, Ethereum gains the room to aggressively raise gas limits, meaning lower fees and faster transactions on the L1 itself. That's an order-of-magnitude scalability upgrade targeting the thing that users have wanted most. Ironically, the rollup-centric era helped get us here. Years of investment in ZK proving systems, originally built for L2s, accelerated zkEVM progress far beyond expectations, bringing what was once Ethereum's most distant ambition within striking distance. The Ethereum Foundation (EF) is now working across six sub-projects to make this happen, from building the data packages provers need, ensuring multiple independent proving systems (SP1, RISC Zero, Jolt) are compatible with different Ethereum clients, and integrating proof verification directly into the consensus layer. The heaviest lift is work on the prover infrastructure itself, since generating ZK proofs requires serious GPU power and will operate as its own standalone layer. Alongside all of this, the EF is benchmarking performance and hardening security before anything goes live. One dependency worth flagging: real-time proving needs more breathing room than validators currently have between producing a block and confirming it. The Glamsterdam hard fork in mid-2026 will widen that window, which is why it's a key milestone on the zkEVM timeline. Bringing Post-Quantum Security to EthereumQuantum concerns are ramping up across the industry – and it's not just a concern for Bitcoin. Justin Drake announced a dedicated post-quantum (PQ) team led by cryptography engineer Thomas Coratger, with bi-weekly core dev calls run by Joseph Asano that kicked off earlier this month. Two $1M bounty programs signal its priority: the Poseidon Prize rewards cryptographers who find vulnerabilities in the Poseidon hash function, and the Proximity Prize incentivizes improvements to ZK proof verification. Multi-client PQ devnets are already live. At its core, the threat is that quantum computers could break the signature schemes securing wallets today, and that our adversaries may already be recording blockchain data to crack later as those machines mature. For a permanent public ledger, that makes the migration timeline urgent. On the solutions front, two leading replacement standards, Falcon (EIP-8052) and Dilithium (EIP-8051) exist in draft EIP form. Both use math that quantum computers can't crack, but differ in tradeoffs around signature size and implementation complexity. The EF isn't forcing a choice between them. Instead, the first PQ dev call emphasized "cryptographic agility" as a design goal, building Ethereum to support multiple signature schemes at once and swap them over time. Account Abstraction already enables this: a working demo on that call showed post-quantum transaction signatures are already possible today. While post-quantum security protects signatures at the network level, a parallel effort focuses on a different kind of protection: keeping user data private in the first place. Client-Side Proving to Turbocharge User PrivacyMost ZK applications generate proofs on remote servers, undermining privacy if your inputs are visible to that server. As Vitalik famously put it, "Privacy is not a feature, but hygiene." True privacy requires proofs generated on your own device. Why don't we have this yet? Consumer devices haven't had the power, and no standard tooling existed. That's changing. Modern phone and laptop GPUs are now capable, and post-quantum ZK proofs are far more efficient to generate on these devices. Benchmarks from the EF's Privacy and Scaling Explorations team show how big the opportunity is – on Apple's latest chips, running post-quantum ZK schemes can actually unlock performance gains, not just enhanced security. What's the holdup then? Most development still targets the older, quantum-vulnerable approach, which won't hold up long-term. And every project building client-side proving is reinventing the wheel since no shared toolkit exists yet. The PSE team's roadmap aims to fix both, building common tools that the whole ecosystem can use. What Comes NextThese three tracks all feed into the same overarching vision. Last July, EF researcher Justin Drake unveiled lean Ethereum, a proposed roadmap for the next decade that reimagines Ethereum's core layers from first principles. The goal: make Ethereum faster, simpler, and hardened against anything – quantum computers, nation-states, whatever comes calling. The zkEVM, post-quantum migration, and client-side proving are each building toward that foundation. And because all three share the same cryptographic building blocks, progress compounds. It's inspiring to see Ethereum driving so clearly toward this multi-year plan, especially given the current state of the market. The lean Ethereum vision has clearly helped the world computer revisit its own foundations and streamline its technical firepower to firm this up. I didn't expect this to happen so quickly but 2026 looks to be the year lean Ethereum starts taking shape in production. FRIEND & SPONSOR: READY Ready makes going bankless simple. With the Ready app, you can buy crypto, earn yield, and stay in control of your assets. Spend USDC anywhere Mastercard is accepted with the Ready Card, with zero fees and 3% cashback. Bankless readers get 20% off Ready Metal with code: BANKLESS20 . . . LATEST POD Surviving the 'Gradual Print' Era Lyn Alden joins us to make sense of the “everything, everywhere, all at once” macro moment.

A fourth-turning-style unwind of the long-term debt cycle, rising fiscal dominance, and a rare, headline-level clash over Fed independence—plus what a Kevin Warsh Fed might actually do under real-world constraints. We dig into the “gradual print” era, why gold is ripping, how a more multipolar monetary order could emerge (gold, bitcoin, and stablecoins in different roles), and what trade war dynamics mean for the dollar’s privilege.

Lyn also explains why Bitcoin has lagged gold this cycle, how much the four-year crypto cycle still matters, the risks around treasury companies and quantum narratives, and how she’s thinking about portfolio construction in 2026.👇 |

No comments:

Post a Comment