| gm Bankless Nation,

As Base's OP Stack departure reverberates, Optimism's OP is continuing to see a massive selloff. Today's Issue ⬇️ - ☀️ Need to Know: Trump Tariff Smackdown

The move brings even more uncertainty to markets. - 🗣️ Analysis: Optimism's Ugly Year

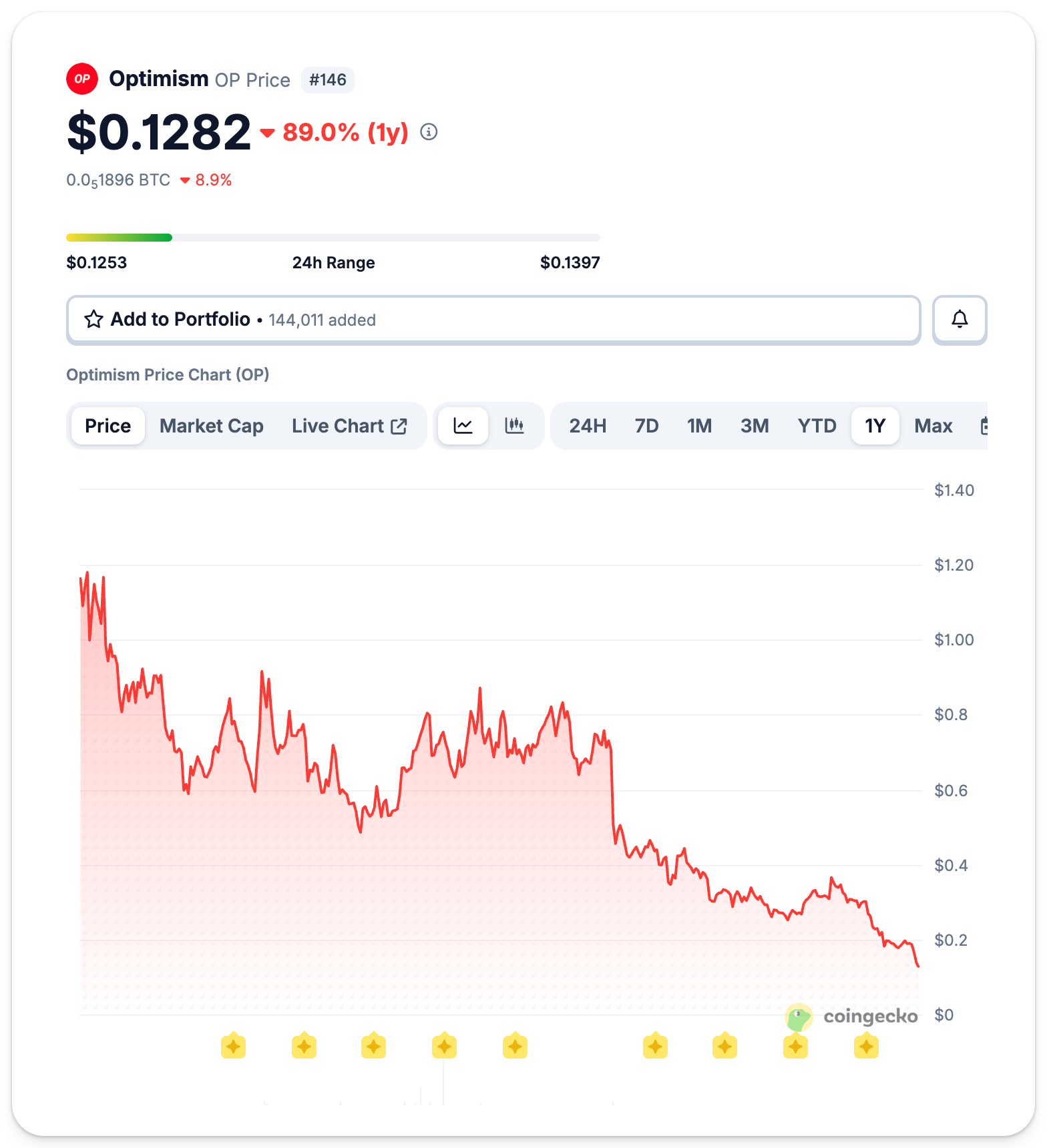

OP's native token is down 89% over the past year.

p.s. Thanks to Rocket Pool. Rocket Pool’s Saturn upgrade is here: RPL stakers can earn ETH via the fee switch, and 4-ETH validators + Megapools are live. Stake your ETH with Rocket Pool! Sponsor: Ready (formerly Argent) — Going bankless is easy when you’ve got Ready.

. . . NEED TO KNOW Trump Tariff Smackdown - 🚢 Supreme Court Reverses Trump Tariffs. Stocks and crypto (briefly) rallied after SCOTUS invalidated Trump's tariff program, though Trump soon pledged to replace the tariffs.

- 🦅 The SEC Is Eyeing a Crypto Innovation Exemption This Year. SEC leadership just offered its clearest signal yet that onchain securities trading in the U.S. is no longer a matter of if, but when.

- 👻 Leading Aave Code Contributor 'Rage Quits' DAO, Cites Centralization Concerns. BDG Labs will cease all contributions to Aave DAO on April 1, 2026.

📸 Daily Market Snapshot: Tariff news still couldn't push ETH back above $2,000 on Friday, as crypto prices seemed to have a more muted reaction to the Supreme Court's tariff news than other high-growth assets. | Prices as of 4pm ET | 24hr | 7d |  | Crypto $2.32T | ↗ 1.0% | ↘ 2.3% |  | BTC $67,722 | ↗ 1.0% | ↘ 1.8% |  | ETH $1,970 | ↗ 1.2% | ↘ 4.1% |

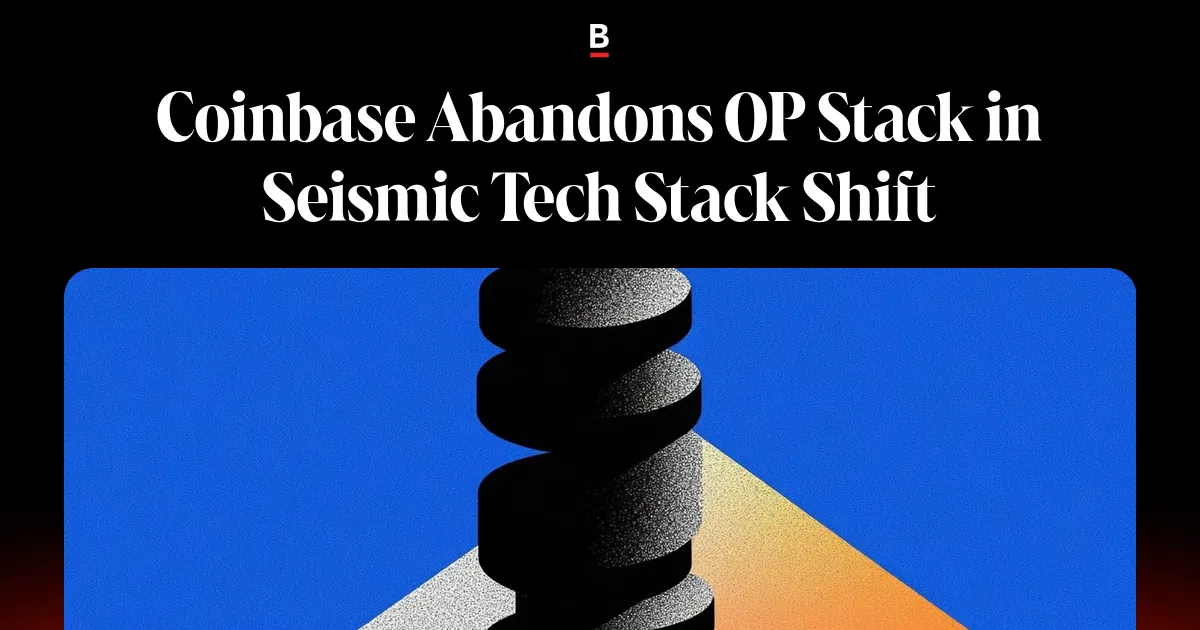

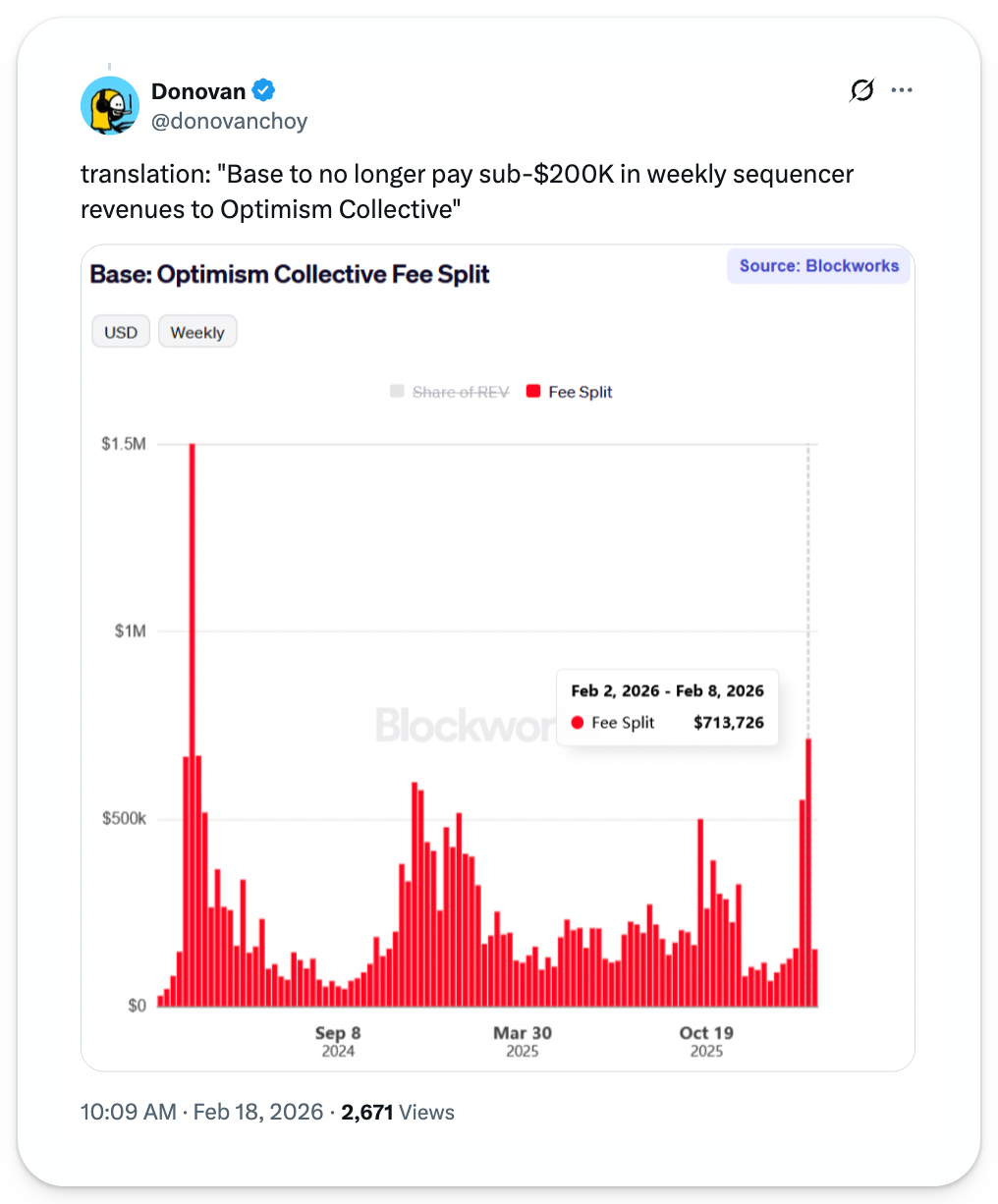

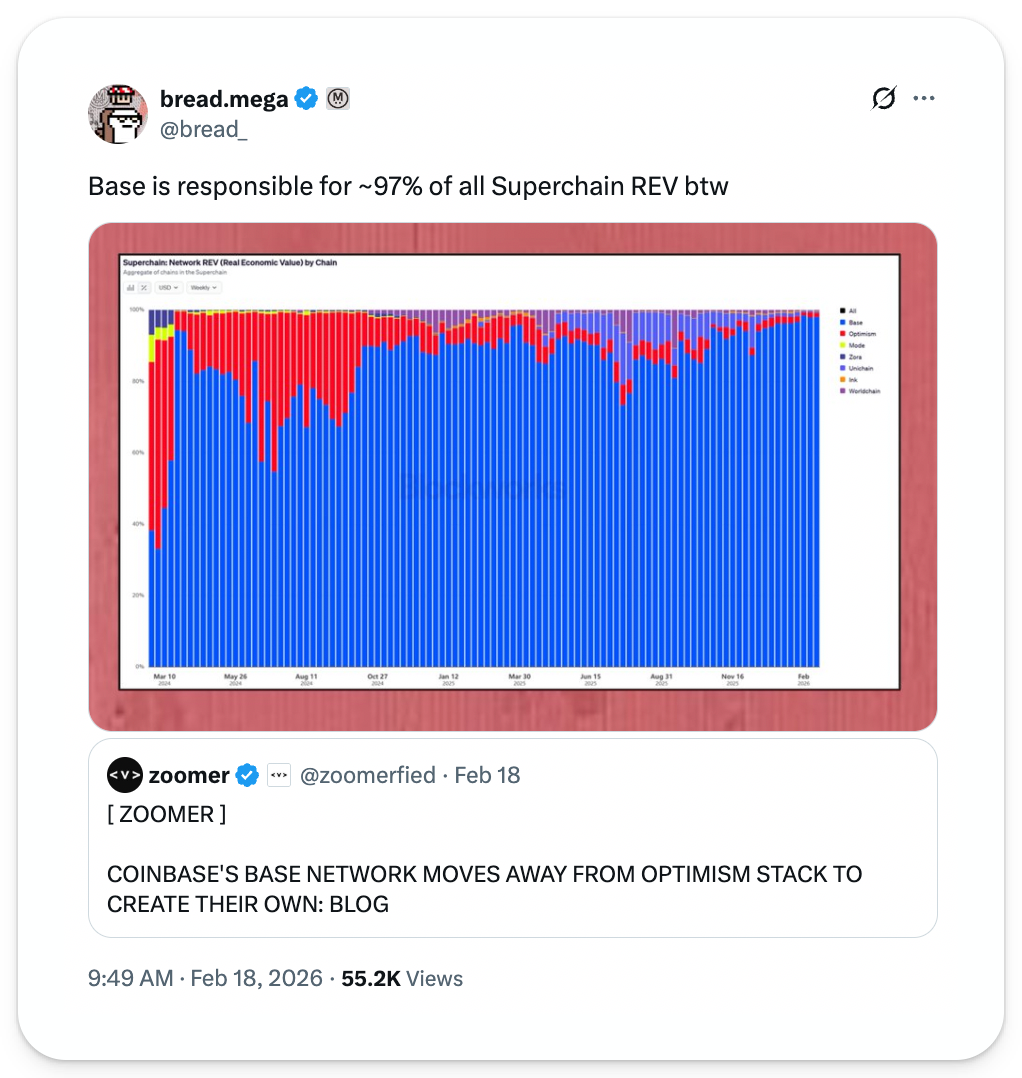

. . . ANALYSIS Optimism's Ugly Year The past year left Ethereum L2 Optimism bloodied and battered, and 2026 continues to twist the knife. For a network once positioned as crypto’s scaling endgame, the reversal has been swift and unforgiving – what went wrong? In 2024, the Optimism “Superchain” was riding high, crowned as the clear victor among L2 scaling efforts after securing integrations from the industry's hottest upstart L2s that appeared to permanently cement its status as crypto’s dominant scaling framework. As ecosystem momentum turned sluggish throughout 2025, OP Stack-related growth metrics grew unilaterally tied to Base's success. In the meantime, OP investors faced brutal losses – after more steep losses this week, the token is down 97% from its March 2024 ATH. Now with Base announcing that they're leaving the OP Stack, we’re unpacking Optimism’s dilemma and exploring how it can compete in a new era of crypto. Optimism’s DilemmaEarlier this week, Coinbase announced it will abandon Optimism's OP Stack, the Ethereum L2 framework that has powered Base Chain for more than three years. In its place comes the new “unified stack.” Effectively, this means forking the open-source OP Stack code base into the Coinbase-controlled base/base GitHub repository and developing it in a segregated environment from the broader Optimism ecosystem. While the OP Stack initially promised to supercharge technical progress by aligning multiple core development groups (i.e.; Optimism and Base) to work toward the same goal, the Base Engineering Team now argues that code isolation will allow it to accelerate development progress by reducing unnecessary communication. Coinbase’s abrupt and unexpected departure from the OP Stack standard represents a meaningful blow to the Optimism ecosystem. For years, Base was held up as proof that the OP Stack model worked: a major U.S. exchange was developing shared infrastructure, contributing revenue back to Superchain, and validating Optimism as Ethereum’s scaling endgame. Now, that symbolic alignment is fractured. Although Coinbase’s unified stack is affixed with an MIT License – meaning it can be freely used, modified, sublicensed, and sold by anyone (including Optimism) – the announcement has triggered immense concern for the future of the Superchain Collective. While the collective includes other high-flying participants like Unichain, World Chain, and Kraken's Ink – the group's public goods fund currently receives an all-time high 97% of its funding from Base. What Comes Next?OP Mainnet – once a mainstay Ethereum L2 for social and trading applications – has long been supplanted by flashier alternatives, like Hyperliquid. Meanwhile, the promised Superchain vision didn't materialize as imagined in its heyday; native interoperability remains non-existent, and no chain besides Base generated sustained traction. Still, while it has certainly been a brutal week for Optimism's team and the OP token, the ecosystem is continuing to pursue new partnerships and growth avenues. On the same day Base abandoned Optimism, Ethereum restaking manager and onchain neobank ether.fi announced plans to migrate "~70,000 active cards, ~300,000 accounts, and millions in user TVL," to OP Mainnet over the coming months. It's been a tough year for OP, but down-bad crypto projects have a habit of bouncing back when even the most modest tidbit of good news is sufficient to fuel a relief rally. Despite the major headwinds facing Optimism, it may be unwise to write off OP investments at this very moment. FRIEND & SPONSOR: READY (FORMERLY ARGENT) Ready makes going bankless simple. Pay with USDC worldwide with zero FX fees and earn up to 3% cashback. Start spending instantly with a virtual card and choose between a free or paid plan. Keep control of your assets. Bankless readers get 20% off Metal with code BANKLESS20 |

No comments:

Post a Comment