Robinhood's Onchain Debut gm Bankless Nation,

Robinhood Chain's testnet just went live, and legacy exchanges are officially on notice. Today's Issue ⬇️ - ☀️ Need to Know: Robinhood's L2 Testnet

Plus, BlackRock brings T-Bills to Uniswap. - 🗣️ Analysis: The MegaETH Launch

A healthier era for crypto is here. - 🎧 Latest Pod: Robinhood Chain vs. Wall St.

Inside Robinhood’s race to 24/7 markets.

Sponsor: Figure — Win $25k USDC with Democratized Prime.

. . . NEED TO KNOW Robinhood's L2 Testnet - ⛓️ Robinhood Launches Testnet for Arbitrum-Based L2 Network. In the coming months developers will gain access to testnet-only assets including stock tokens for integration testing.

- 🫣 Tornado Cash Developer Roman Semenov Added to FBI's "Most Wanted" List. Trump’s FBI is escalating its search for one of crypto's most renowned privacy devs.

- 🦄 BlackRock Brings BUIDL T-Bill Trading to Uniswap. The asset management giant also made a strategic investment in the Uniswap ecosystem, though details of the deal weren't disclosed.

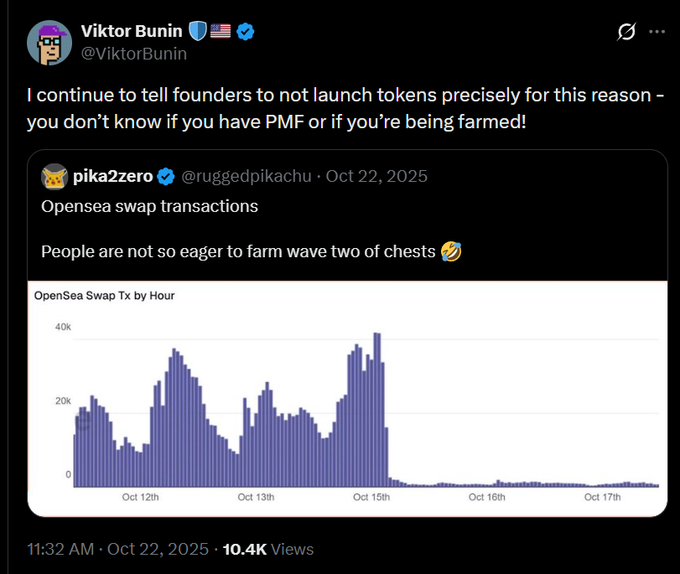

📸 Daily Market Snapshot: With >70% of the top 100 coins dipping further into the red today, the biggest breakout came via LayerZero's ZRO token, which has surged 40% upon yesterday's announcement of the Zero L1. | Prices as of 3pm ET | 24hr | 7d |  | Crypto $2.37T | ↘ 1.8% | ↘ 10.2% |  | BTC $67,489 | ↘ 2.0% | ↘ 8.2% |  | ETH $1,950 | ↘ 3.0% | ↘ 9.2% | . . . ANALYSIS On the Launch of MegaETH Last week was historically brutal across crypto. Bitcoin is down ~50% over four months — four red monthly candles in a row. ETH is down ~55% over five months — extreme territory by any historical standard. And on Monday, MegaETH launched. I’ve seen a handful of takes about the MegaETH launch that feel outdated — not just because the market regime has changed, but because MegaETH’s strategy is explicitly designed for this new regime. Historically, chain launches came with fireworks — apps cut the ribbon with subsidized yields and point campaigns. “InfoFi” incentivized slop so chains could buy attention and climb the X feed. Historically, chains would consume capital to manufacture activity. That is not the market we’re in now. We’re in a crypto winter. Users are scarce. TVL is scarce. Launches are sparse. User acquisition is expensive. Crypto simply isn’t exciting to most people right now. At the same time, the industry has come full circle back to public token sales — and thank god for that! Airdrops and points campaigns were fun for highly engaged users, but they were an inefficient way to get tokens into the hands of long-term aligned holders. Those programs didn’t treat tokens like precious equity, and thus neither did the market. MegaETH's strategy with the introduction of $MEGA reflects this market environment. In fact, they were far ahead of the curve with being highly discretionary and intentional about their token distribution. MegaETH has never 'given away' their token — no airdrops, points, or InfoFi campaigns. They never traded their token for short-term gains in usage or TVL metrics. So, when you see tweets trying to dunk on MegaETH’s relatively low transaction counts or TVL, you’re accidentally anchoring to a fake reality leftover from 2024/25 MegaETH’s metrics are far more organic and less adulterated than any chain we have seen in recent years. It's MegaETH's explciit strategy to treat their token as precious, and not simply pay people to show up — we know by now when you do this, you end up attracting the wrong people. This has not been true for previous chain launches — in order to cut through the noise and command attention from the market, chains and their app ecosystem would issue points and farming incentives to boost their relevancy in the market. These rewards would go into the hands of farmers and mercenaries, who would then liquidate their rewards, at the cost of long-term believers who got poor as a result.  absolute retardio Now, I can't speak for every MegaETH app, but it appears that the ecosystem is following the lead of the chain. MegaETH apps are not paying you to use them. Instead, they are chewing glass and doing the hard thing of winning users organically, instead of giving away their token to the market. This is why TX volume and TVL is low. It is TUESDAY for christ-sake. MegaETH launched YESTERDAY. All chains start at ZERO and grow from there — and if you elect to not fake metrics via token subsidies, then the metrics are going to grow more slowly than previous examples who gave away their token for short-term metrics. When founders engage in metric subsidies, they fake themselves, and their investors, into believing they have PMF, when really they're just being farmed. So, as we judge chain launches of 2026 and beyond, we should be aware that we have entered a new market environment, and strategies have adapted. Comparing MegaETH to the highly subsidized chain launches of 2024 and 2025 is foolish, and also not what we want to encourage in our ecosystems. We all know how incentivized campaigns went it's not what we want from our future ecosystems. So, for the sake of our industry, have patience. MegaETH is doing the right thing — the thing we were all begging chains and apps to do for the past 2 years. Treat your token as precious.

Stop gamifying and subsidizing short-term metrics.

Engage in the product-market feedback loop.

Chew glass. My final thought is this:The fact that MegaETH is bringing a bunch of novel and unique apps to CT at the same time that the industry is experience the least amount of noise we've seen since 2023 is an absolute blessing. Fortunes will be made when it is non-consensus. Onwards. =========== A collection of takes: - 40 TPS in under 24 hours is a lot!

- Correct! People are simply not used to "Real and Organic" launches in crypto.

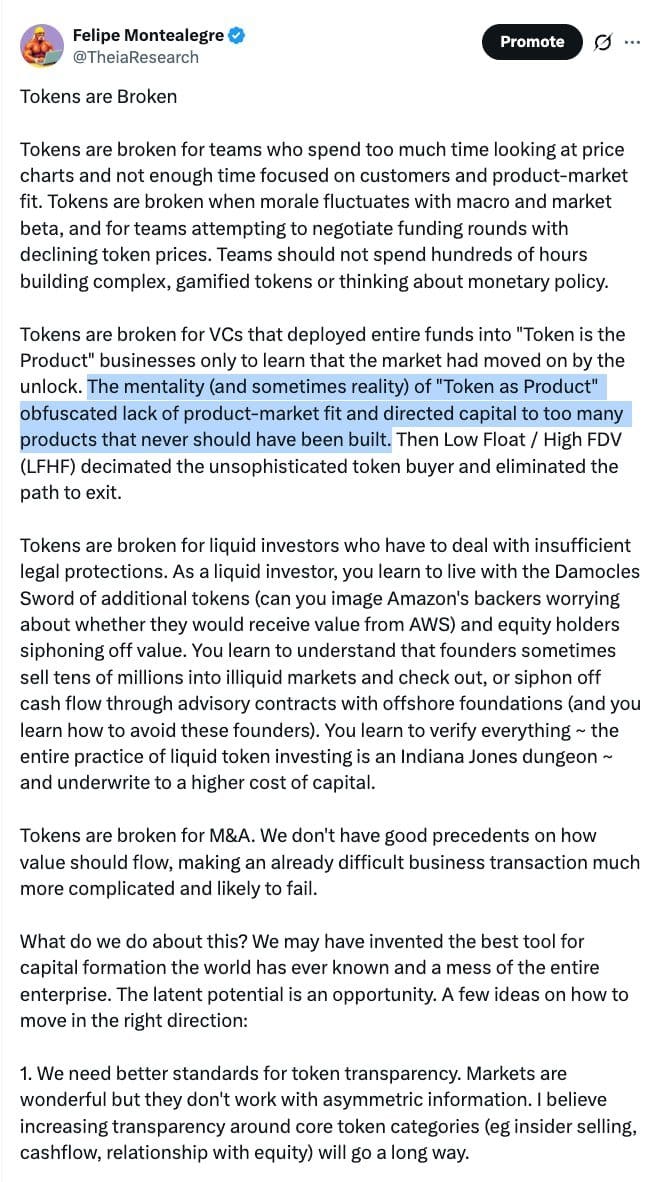

As you can see below, Felipe has also been advocating for this kind of behavior for years now. Since he represents the liquid market investor that this industry so desperately needs (to buy our tokens!), we should probably listen to him!  FRIEND & SPONSOR: FIGURE Use Figure’s Democratized Prime for your chance to win big with $25k USDC. The more you participate, the better your odds! Every dollar gets you another chance to win $25K USDC. Enter to win while earning 9% yield on your crypto with Democratized Prime*. . . . LATEST POD Robinhood Takes On Wall Street Robinhood is assembling a new exchange stack: stock tokens, an Ethereum L2 built for real-world assets, and a wallet designed to plug users straight into DeFi. On today’s episode, Robinhood Crypto GM Johann Kerbrat joins David to break down the Robinhood Chain public testnet, what builders can do with it now, and why Robinhood is taking an open approach instead of the closed rails favored by legacy exchanges. They also unpack what “24/7 markets” actually requires (spoiler: liquidity and routing are the battleground) and what regulatory clarity would be needed to fully unlock stock tokens in the U.S. Catch the full conversation below! 👇 . . . |

No comments:

Post a Comment