It’s been a week since we wrote ‘No Illusions,’ and what turbulence we’ve experienced. Augustine wrote a great postmortem on bitcoin’s price action over the past few days. A lot of investors and analysts are searching for answers about what really went down. In private Telegram groups, people are still pointing to Binance flows, which have been “abnormal” since October 10, 2025. Jeff Park pointed to the growing intertwining of bitcoin and traditional finance. Last but not least, Jordi Visser pointed out that a lot of capital was invested in 2021 in “crypto” broadly, and in SaaS companies and startups. A lot of capital went into both trades during the same period. With bitcoin underperforming other assets, and with Anthropic and other AI companies building models so good that people are questioning SaaS business models, this probably led to de-risking and deleveraging across positions. Deleveraging and de-risking it was. The foundations of money are shifting in ways that are easy to feel but harder to name. Persistent deficits, rising debt, and central bank behavior are quietly reshaping how investors think about preservation and risk. In The Debasement Trade, James Lavish explains why currency debasement is structural, why traditional portfolio assumptions are being tested, and why gold tends to move first while bitcoin often moves further as the implications compound. The report covers:

❌ DON’T WRITE YOUR SEED ON PAPER 📝 Why? Because securing your generational wealth on paper is risky. It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

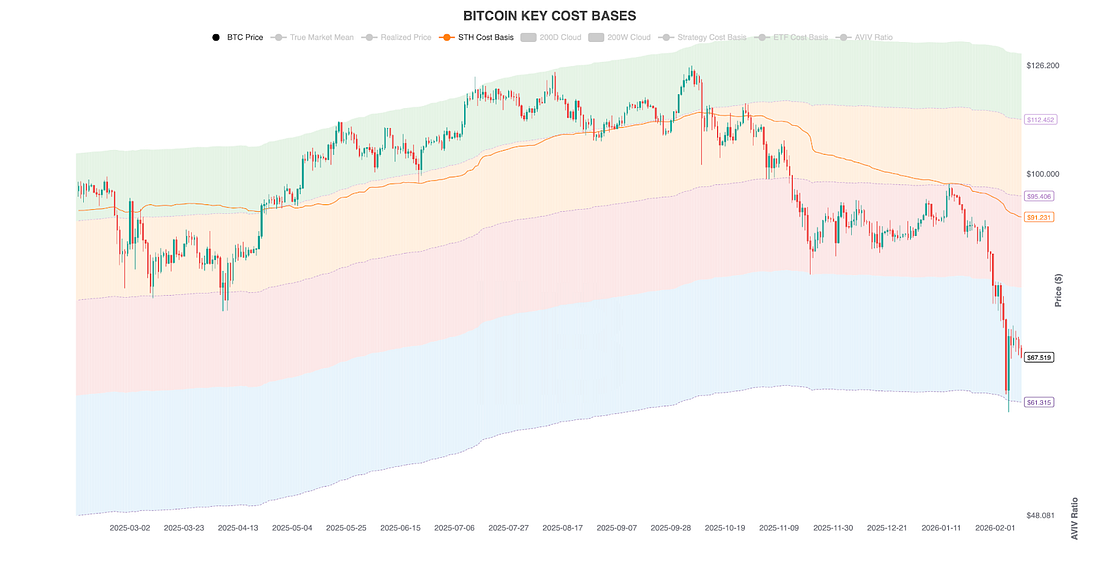

Use code TBL to take 15% off your purchase. While writing the letter last week, with bitcoin trading at $75,000, we made the case that we’d entered the “Winter Zone,” and that $58,000 should be on your radar. We weren’t sure we’d get there, but it made sense to prepare for the possibility because of the weakness. We were thinking in terms of weeks and months, not two days later. Price fell through the entire “Winter Zone” and even went below $60,000. I’m not sure if price touched the $58K mark; maybe it depends on which exchange you’re looking at, but it was a severe, vicious sell-off. Let’s start looking more closely at how other bear markets developed, and what we should expect next. In this chart, we toggled off the AVIV framework so we can focus on the 200-week cloud, which consists of a simple moving average and an exponential moving average. The Realized Price is also visible. In other bear markets, we always went below the Realized Price, which is currently at $55,066. But we didn’t always go below the 200-week cloud. In 2018, that was support. We did fall below both after the 3AC and FTX shenanigans in 2022. Price needed nine months to recover from that blow... Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Wednesday, February 11, 2026

When The Going Gets Tough

Subscribe to:

Post Comments (Atom)

Popular Posts

-

How Bitcoin was born to end reliance on broken systems and deliver the world’s first truly scarce digital money ͏ ͏ ͏ ͏ ...

-

From Treasury Titan to Distress Sale? MSTR Down 53% in a Year Amid Extreme Fear ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Why short-term moves matter less than the big picture ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The most bullish Ethereum upgrade of all time is on the horizon. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment